What is the 4 percent rule in retirement planning? What is the Safe Withdrawl Rate (SWR) in retirement? What is the Boglehead view of the 4 percent rule and the safe withdrawl limit?

Retirement planning can be a daunting task, and it’s important to have a solid plan in place to ensure you can enjoy your golden years without financial stress. One popular rule of thumb is the 4% rule, which suggests that retirees can safely withdraw 4% of their retirement savings each year without running out of money.

In this blog post, we will take an in-depth look at the 4% rule and explore its mechanics, pros, and cons. We will also discuss its relationship with Social Security benefits, tax implications, and alternatives to the strategy. Additionally, we will provide real-life case studies to help you understand how the 4% rule works in practice and determine if it’s still relevant in today’s economic climate.

Understanding the 4% Rule

Assessing retirement savings, withdrawal rates, and portfolio value is essential in understanding the 4% rule. Retirees must comprehend the first year of retirement withdrawal, subsequent years, and making necessary spending plan adjustments. Evaluating risk tolerance, market conditions, and historical data informs the understanding of this rule, which plays a crucial role in retirement income. Furthermore, understanding the cost of living, health care expenses, and income sources in the context of the 4% rule is vital for retirees’ financial well-being.

Concept and Origin of the 4% Rule

The 4% rule, originating from historical market data and retirement spending patterns, first introduced by financial advisor William Bengen, gained popularity for its simplicity and practicality in retirement planning. It conceptually suggests a safe withdrawal rate from retirement savings, addressing the balance between spending needs and investment returns. This rule is a rule of thumb used by financial planners to determine a retiree’s annual withdrawal rule, ensuring enough money for personal use in the long term.

How the 4% Rule Works in Practice

The 4% rule recommends an initial withdrawal of retirement savings and assumes subsequent annual withdrawals adjusted for inflation. This guideline ensures a steady income stream with potential for portfolio growth, allowing retirees to plan their spending and maintain financial security throughout retirement years. Financial planners emphasize the rule of thumb as a long-term strategy, considering the rate of inflation and the total amount of money needed for personal use.

The Use of the 4% Rule in Retirement Planning

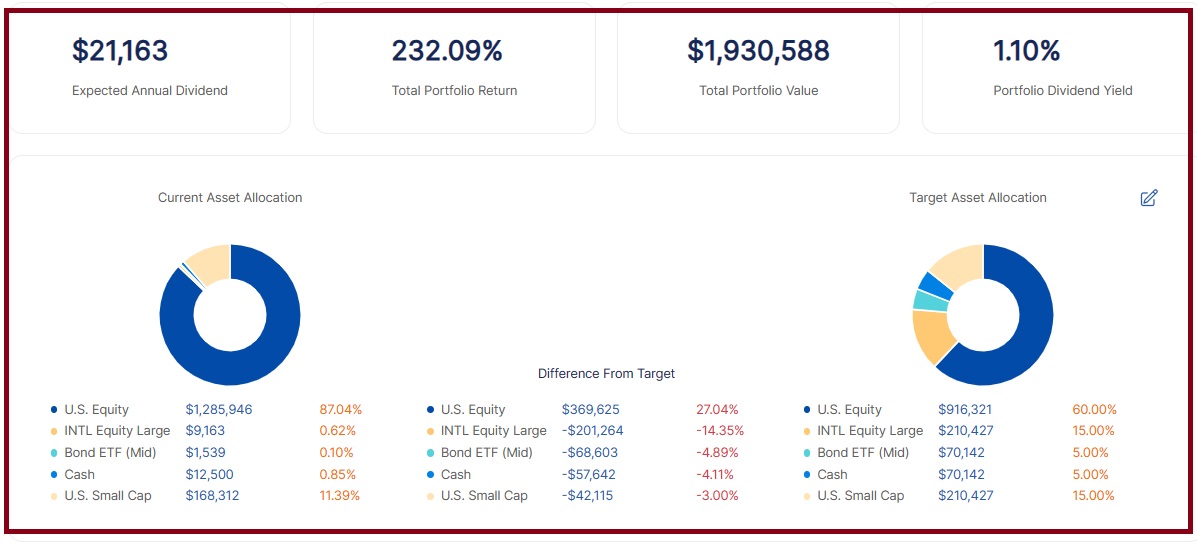

The 4% rule, a retirement spending plan, provides a structured approach for retirees to manage their nest egg. Financial experts utilize this rule to balance income sources and expenses, aiding in determining retirement portfolio value and spending plan. Serving as a guide for informed financial decisions, the 4% rule helps retirees navigate their long-term financial security. This rule of thumb offers a practical methodology for retirement planning, addressing the complexities of managing finances in the senior years.

Exploring the Mechanics of the 4% Rule

Calculating the initial withdrawal amount is at the core of the 4% rule’s mechanics, helping retirees assess their retirement income sources. This calculation considers life expectancy, market conditions, and risk tolerance, using historical data to meet future financial needs. The rule’s framework factors in inflation and investment strategy to ensure a sustainable income stream. This methodology isn’t a fast rule but a guideline that financial planners and advisers use for long-term personal use.

Calculation Methodology of the 4% Rule

The calculation methodology of the 4% rule involves evaluating retirement funds and total balance, taking into account the annual withdrawal amount and subsequent years of retirement. This method incorporates interest rates, bond returns, and mutual funds to calculate the withdrawal amount based on retirement spending plans while considering specific circumstances and health care expenses for retirees. The aim is to determine a structured approach to manage the retirement nest egg without introducing unnecessary risk.

The Role of Inflation in the 4% Rule

In the 4% rule for retirement, the role of inflation is crucial. This rule adjusts annual withdrawals to address the impact of inflation on purchasing power, incorporating inflation rates for long-term financial sustainability. Retirees use this rule as a withdrawal rule of thumb to mitigate inflation’s effect on retirement funds. Financial planners and senior vice presidents recommend considering the rate of inflation to ensure enough money for personal use in the long term.

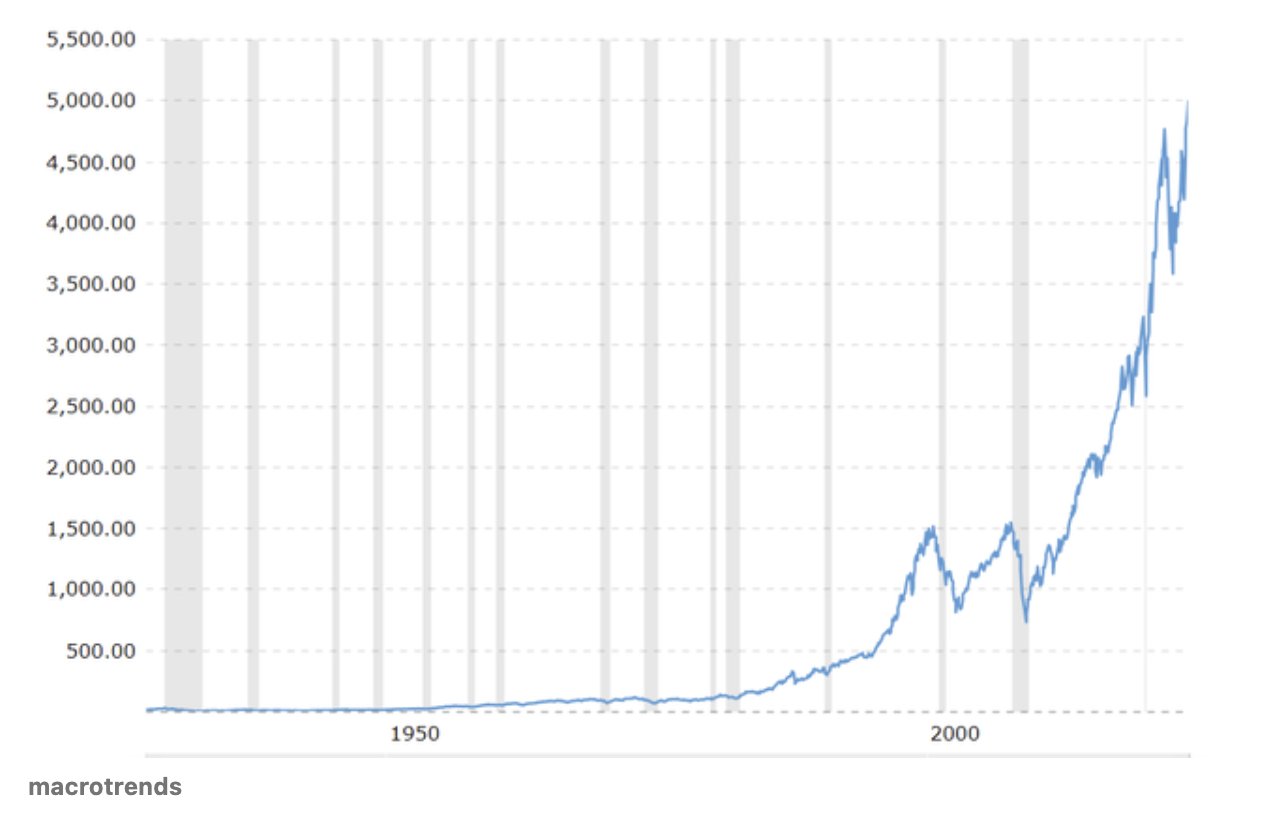

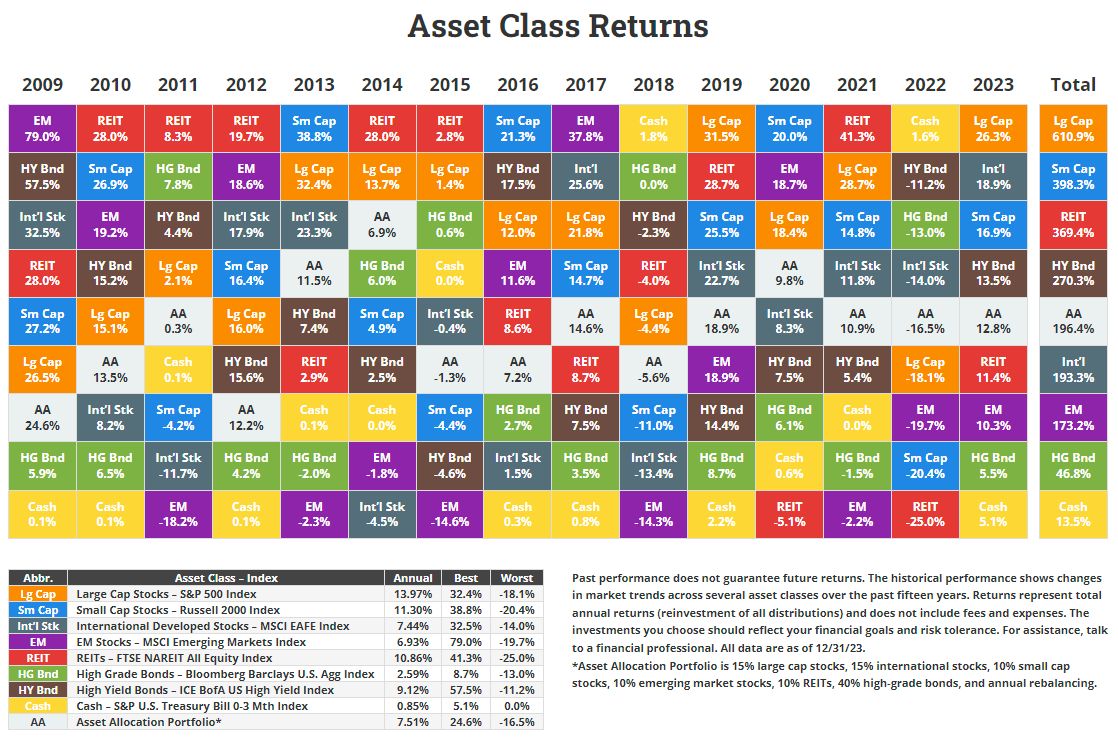

The Impact of Market Conditions on the 4% Rule

Market conditions significantly influence the portfolio value and withdrawal rate under the 4% rule, showcasing varying impacts based on historical market data and investment performance. This rule considers retirees’ risk tolerance and financial crisis preparedness while also adapting to changing investment environments. Retirees are keen on evaluating market conditions to ensure their financial stability, as it’s a crucial aspect of maintaining sustainable retirement income.

The Pros and Cons of Using the 4% Rule

The 4% rule is a reliable withdrawal rule offering retirees a financial planning rule of thumb for income sustainability. It balances retirement income and spending needs, providing flexibility for personal use. However, its reliance on historical data may not fully reflect current market conditions, requiring evaluation based on long-term financial impact and the rate of inflation. Financial planners and senior vice presidents recommend considering alternatives, as there’s no fast rule for enough money in retirement.

Advantages of Implementing the 4% Rule

When implementing the 4% rule, retirees can create a steady income stream, ensuring financial stability and predictable retirement spending. This structured approach allows long-term financial security and effective management of retirement funds. By balancing income sources and expenses, retirees can utilize the total amount for personal use. Financial planners and senior vice presidents often recommend this rule of thumb to ensure enough money for the long term, without a fast rule for withdrawal.

Potential Drawbacks of the 4% Rule

While the 4% rule offers a guideline for retirement planning, its potential drawbacks must be carefully considered. The rule’s reliance on historical market data may not fully account for individual financial circumstances and specific retirement needs. Market conditions can significantly impact the rule’s withdrawal rate, requiring retirees to evaluate its sustainability. Additionally, it may not fully address medical expenses, life insurance, and other unforeseen costs, necessitating a comprehensive approach to retirement income management.

The 4% Rule and its Relationship with Social Security

The 4% rule, introduced by financial advisor William Bengen in 1994, guides retirement withdrawals based on portfolio balance. This rule suggests an annual withdrawal rate to sustain a retirement portfolio for approximately 30 years, relying on historical market conditions and bond returns. It serves as a useful withdrawal rule of thumb, but its relationship with Social Security benefits and the rate of inflation must be considered by retirees for long-term financial planning. Financial planners advise individuals to evaluate the total amount of retirement funds for personal use and analyze whether it’s enough money for a secure retirement

How Social Security Affects the 4% Rule

Social Security benefits play a pivotal role in retirement spending strategies. Understanding these benefits is crucial for determining a safe withdrawal rate. Impacting both the initial withdrawal rate and subsequent years’ spending plan, Social Security income significantly influences retirement fund withdrawals. Many retirees adjust their withdrawal rates to align with their Social Security income, emphasizing the interplay between retirement savings and this governmental support. This personalized approach ensures a sustainable and balanced retirement income.

Interplay between the 4% Rule and Social Security Benefits

Balancing retirement portfolio and Social Security income is crucial in retirement income planning. The 4% rule and Social Security benefits together create steady income, influenced by factors like life expectancy, risk tolerance, and investment strategy. Personal circumstances and health care expenses also affect the interplay, emphasizing the need for a tailored approach. Understanding the relationship between the 4% rule and Social Security benefits is essential for long-term financial planning.

Alternatives to the 4% Rule

Retirees have alternative withdrawal strategies to consider. Some may opt for a dynamic withdrawal approach based on portfolio performance, while others choose a bucket strategy, segregating assets into different time horizons. A bond tent strategy involves holding higher bond investments in early retirement years, and an annuity strategy offers an alternative for retirement income. These alternatives provide retirees with diverse options to ensure financial stability during retirement.

Other Retirement Withdrawal Strategies

When planning for retirement, individuals may consider various withdrawal strategies to ensure a steady income stream. One such approach is the guardrail strategy, which involves adjusting annual withdrawal rates based on portfolio performance. Another option is the rising equity glide path strategy, where retirees start with a lower initial equity allocation and gradually increase it. Additionally, retirees can utilize a floor and upside strategy, setting a minimum spending floor with additional spending based on portfolio returns. The probability-based strategy calculates safe withdrawal rates based on historical data and market conditions, while the constant inflation-adjusted withdrawal strategy maintains a steady income adjusted for inflation.

Comparing the 4% Rule with other Retirement Fund Strategies

When evaluating retirement fund strategies, it’s crucial to consider risk tolerance, market conditions, and financial goals. Assess how each strategy addresses inflation, interest rates, and life expectancy, while factoring in retirement spending, investment approach, and healthcare expenses. Different strategies may impact taxes, retirement funds, and long-term financial security. Flexibility, cost of living, and income sources should also be taken into account for retirees.

The 4% Rule and Tax Implications

Retirees must consider tax implications when utilizing the 4% rule for retirement income. Understanding the impact on income tax, capital gains tax, and investment taxes is crucial. Evaluating the tax efficiency of portfolio withdrawals under the 4% rule is important. Additionally, managing taxes related to required minimum distributions (RMDs), social security benefits, Roth conversions, and traditional IRA withdrawals demands special attention. Considering the tax consequences of the 4% rule is essential for long-term financial security.

Understanding the Tax Ramifications of the 4% Rule

When implementing the 4% rule, retirees must consider the tax implications based on their total balance, withdrawal amount, and retirement income sources. Assessing the tax treatment of retirement funds, investment gains, and dividend income is essential for proper tax planning. Furthermore, retirees should evaluate the impact of retirement spending, medical expenses, and long-term care costs on their taxes while also considering specific circumstances and financial goals. Understanding the tax-efficient withdrawal of retirement funds is crucial for tax management under the 4% rule.

Practical Tips for Managing Taxes under the 4% Rule

When managing taxes under the 4% retirement rule, consider utilizing tax-efficient investment vehicles like Roth IRAs. Additionally, retirees should explore tax-loss harvesting and capital gains management for optimizing tax liabilities. Charitable giving and donor-advised funds can provide tax benefits while managing retirement income. Essential factors include managing retirement income based on tax brackets and deductions, and seeking guidance from financial advisors specializing in retirement tax planning. These strategies can play a crucial role in tax optimization.

Case Studies of the 4% Rule in Action

Real-life retirees’ experiences with the 4% rule offer valuable insights, demonstrating its adaptability to diverse market conditions and retirement plans. These case studies provide a tangible understanding of how the rule impacts retirement spending plans and how retirees manage tax implications and unexpected expenses. Additionally, they aid in evaluating the long-term sustainability of the 4% rule, offering practical lessons for those considering its application to their personal retirement strategies.

Real-life Examples of the 4% Rule

Real-life application of the 4% rule offers valuable insights for retirees, showcasing diverse circumstances, spending plans, and investment strategies. Case studies also emphasize the impact of risk tolerance, financial crises, and historical market data on its implementation. Understanding how withdrawal rates are adjusted based on portfolio value and market conditions is crucial. Moreover, real-life examples illuminate retirees’ management of health care expenses and long-term care costs under the 4% rule, demonstrating the evolving nature of retirement income sources and withdrawal strategies.

Is the 4% Rule Still Relevant Today?

Assessing the continued relevance of the 4% rule in retirement planning is crucial. Considerations include market conditions, interest rates, inflation, and portfolio value. Additionally, understanding retirees’ evolving needs, financial crises adaptations, and social security updates are important factors. Insights from experts and historical data provide perspectives on its contemporary applicability.

Conclusion

In conclusion, the 4% rule is a widely recognized retirement planning guideline that provides a framework for sustainable withdrawals from a retirement portfolio. It offers a balance between enjoying your savings and making them last throughout your retirement years.

While it has its advantages, such as simplicity and flexibility, there are also potential drawbacks to consider, such as market volatility and inflation. It is important to understand the mechanics of the 4% rule and how it can be impacted by factors such as social security benefits and tax implications.

The “trap” in planning is to get into “analysis paralysis”. So you can use the 4% rule as a guideline to your investment planning, you can always alter your plan if a better solution comes along.

Remember, everyone’s financial situation is unique, so it’s crucial to consult with a financial advisor to determine the best approach for your specific needs.