This blog dives into the details of Boglehead portfolio rebalance. Why you should rebalance, when you should rebalance, and even how to use new funds to rebalance.

Portfolio Rebalancing is a key piece to the investing puzzle that maximizes investment return and minimizing risk.

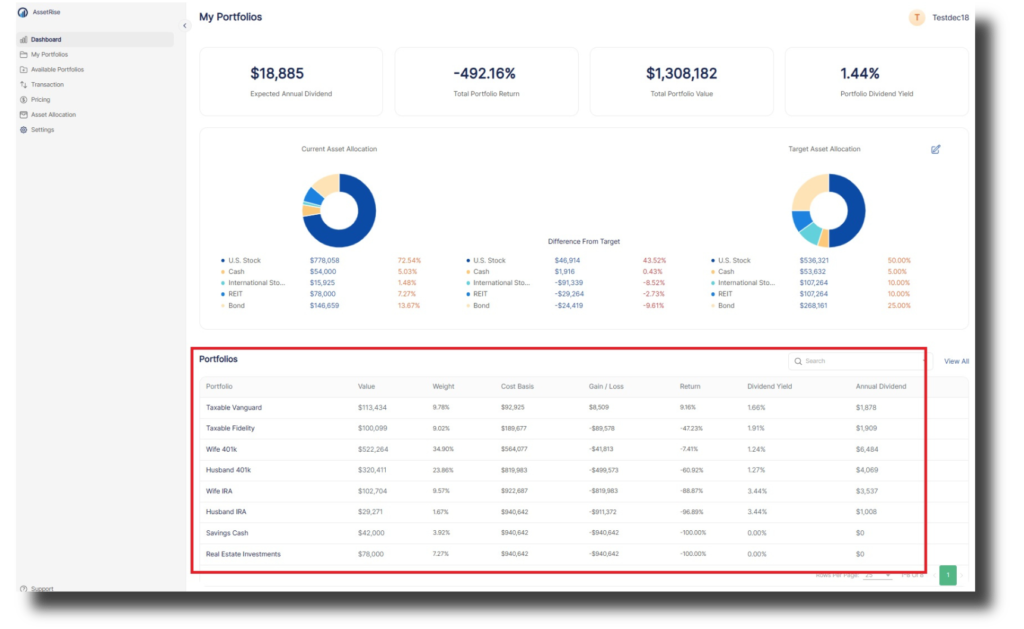

Vanguard, FIRE, and Boglehead investors keep their asset allocation simple which allows for easy rebalancing. AssetRise is designed to simplify asset allocation and rebalancing through our current vs. target dashboard.

Let’s dig into the benefits and considerations when rebalancing your portfolio.

What does it mean to rebalance a portfolio?

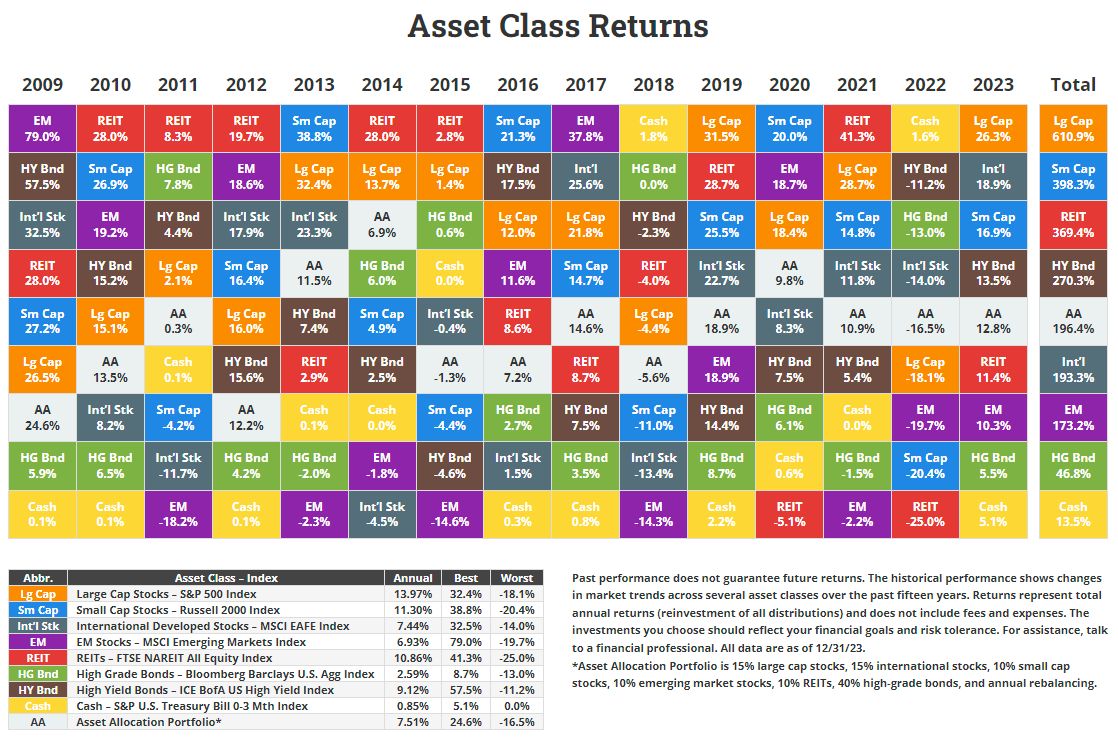

Investment portfolio rebalancing refers to the process of returning the values of a portfolio’s asset allocations to the levels defined by an investment plan. These levels are intended to match an investor’s tolerance for risk and desire for reward. Over time, asset allocations can change as market performance alters the values of the assets.

Rebalancing typically involves selling assets that have outperformed their target allocation and using the proceeds to purchase assets that have underperformed. This helps maintain the relative weights of different assets to their target allocation, thus reducing the overall level of risk in the portfolio.

Investors may also wish to adjust their overall portfolio risk to meet changing financial needs. For instance, an investor who needs a greater potential for return might increase the allocation in assets that involve higher risk, such as equities, to improve that potential. Or, if income becomes more important than it was before, the allocation of bonds could be increased.

Benefits of portfolio rebalancing

Portfolio rebalancing offers several benefits:

- Maintaining your intended asset allocation and risk exposure: The primary purpose of rebalancing is to manage risk, not to beat the market. It helps maintain the relative weights of different assets to their target allocation, thus reducing the overall level of risk in the portfolio.

- Buying low and selling high: This is the dream scenario for all investors. Rebalancing involves selling assets that have increased in value (selling high) and buying more of those that have decreased in value (buying low).

- Sticking to a rules-based approach: Money is an inherently emotional topic. Rebalancing helps investors stick to a predetermined strategy, which can be beneficial in volatile markets.

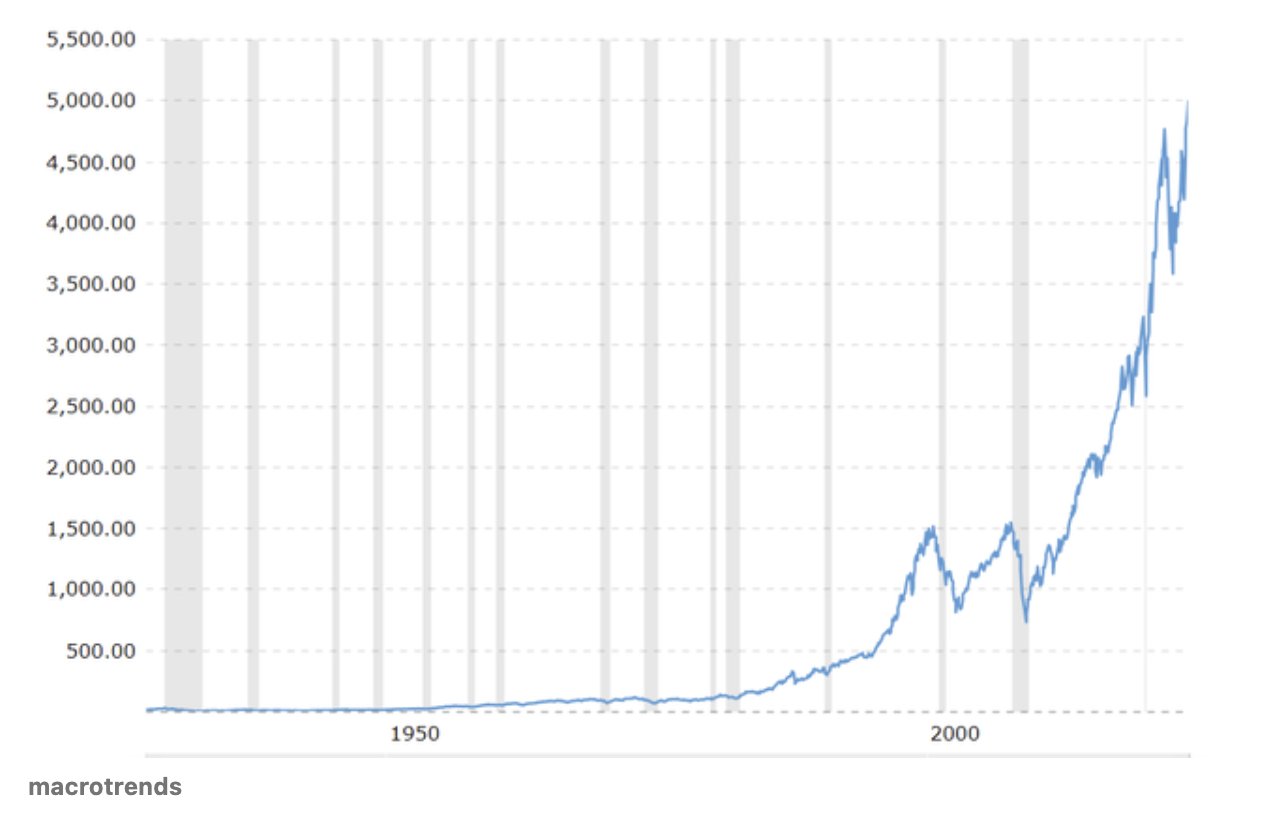

- Improved returns: In addition to keeping your risk in check, rebalancing can actually improve your investing returns when you rebalance two or more asset classes that have similar long-term expected returns.

Remember, while rebalancing can offer numerous benefits, it’s important to consider transaction costs and potential tax implications before making any changes to your portfolio.

Portfolio Rebalancing Considerations

The frequency of portfolio rebalancing is a personal decision and can depend on a variety of factors, such as age and risk tolerance. However, it is generally recommended that a portfolio should be rebalanced at least once a year. Some investors choose to do it more frequently, such as monthly, quarterly, or biannually.

Another approach is to rebalance once your asset allocation reaches a specific tipping point. For example, if you’re focused on investing 80% of your portfolio in stocks and 20% in bonds, you may set a rule for yourself to rebalance any time the stock portion of your portfolio grows to 85%. This is a fairly standard rule of thumb to follow, though you may choose a different percentage instead.

Remember, rebalancing is more about how far the portfolio has drifted, if it has drifted at all. Also, keep in mind that while rebalancing can help maintain your desired level of risk, it’s important to consider transaction costs and potential tax implications before making any changes.

Vanguard and Boglehead investors consider a number of rebalance approaches. However the most common is to rebalance based on “bands” or you set a threshold for an asset class allocation. When you hit the threshold its time to rebalance.

Tools to Track Asset Allocation

Spreadsheets: May investors build custom spreadsheets to track asset allocation, rebalance bands, current vs. target, and dividend returns.

- PRO: Low cost, customize to individual

- CON: Hard to maintain, complex with multiple accounts, high learning curve, Google Sheet formulas are a pain to keep up.

Here are sample spreadsheets on the Boglehead forum and on AssetRise

AssetRise: AssetRise is designed to simplify asset allocatio and rebalancing:

- PRO: Online tool, current vs. target allocation including rebalance amount across many accounts, auto-notifications and alerts to rebalance, no spreadsheets to maintain

- CON: Subscription cost

How AssetRise Simplifies Rebalancing

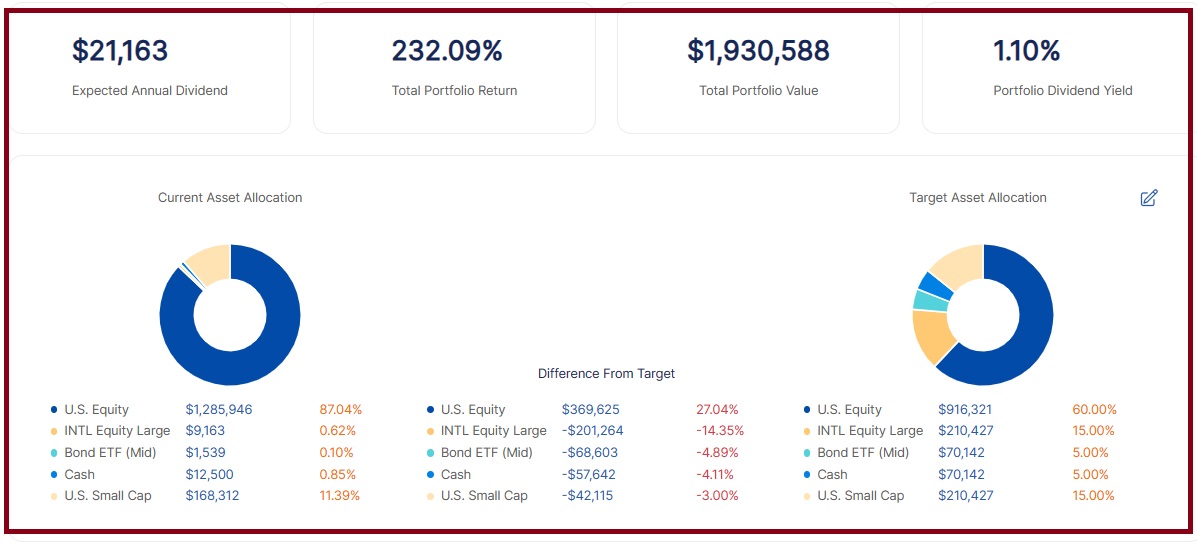

AssetRise summarizes your target asset allocation vs. current allocation across all your investments, including the exact amount to stay in balance.

AssetRise offers a simple dashboard visual including all the key information you need to manage and rebalance your portfolio including:

- Current Asset Allocation

- Target Asset Allocation

- Rebalance Amount

- Account Level Dashboards

- Dividend Income Projections

- Portfolio Return %

Take a look at the AssetRise interface below:

In Conclusion

Portfolio rebalancing is critical to your long term portfolio return. The main reason is to take advantage of a down market by rebalancing into assets that have dropped.

By having a clear picture of your portfolio asset allocation at all time, it will allow you to make quick decisive decisions to maximize your portfolio returns.

We recommend assetrise.com as it was designed for Boglehead ETF investing focused on simplicity, low cost, and simple to use.