Boglehead 3-Fund Portfolio for Beginners

Are you new to investing and looking for a simple yet effective investment strategy? Look no further than the Boglehead 3 Fund Portfolio. This investment strategy, based on the philosophy of legendary investor John Bogle, emphasizes simplicity, diversification, and cost-effectiveness.

In this blog, we will dive deep into the Boglehead 3 Fund Portfolio, exploring its key components, benefits, historical performance, risks associated with it, and how to implement it in 2024.

Whether you’re a beginner or an experienced investor looking to simplify your portfolio, read on to find out if the Boglehead 3 Fund Portfolio is the right choice for you.

Understanding the Boglehead 3 Fund Portfolio

The Boglehead 3 Fund Portfolio presents a straightforward yet efficient investment approach, emphasizing a passive, low-cost strategy. This portfolio, based on the philosophy of Vanguard Group’s founder John Bogle, comprises US total stock market, total international stock market, and total bond market index funds. It allows investors to achieve high diversification across global markets.

The Philosophy Behind the Boglehead 3 Fund Portfolio

Grounded in simplicity, low cost, and broad diversification, the Boglehead 3 Fund Portfolio embodies the investment philosophy of John Bogle. It prioritizes long-term, low-turnover, and low-cost strategies to maximize returns while minimizing expenses and taxes.

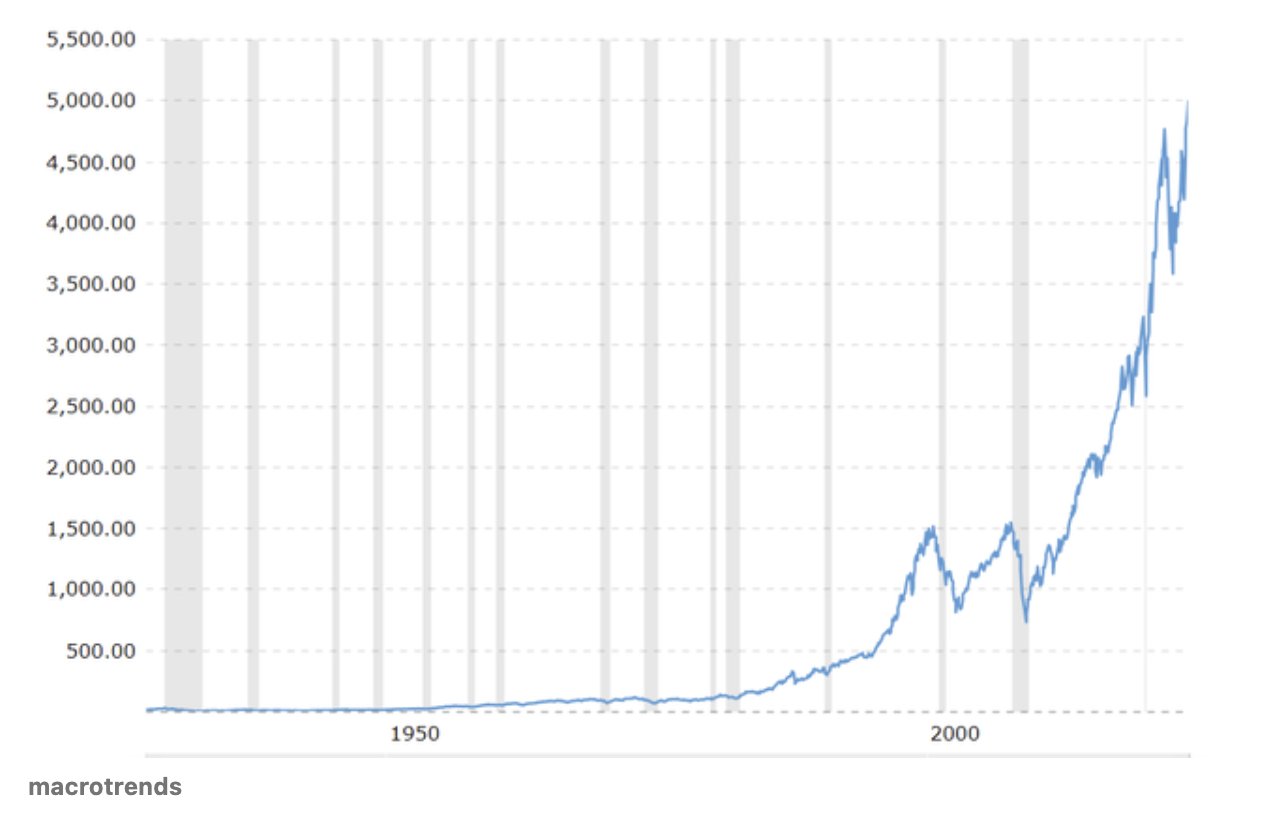

This approach reflects the belief that consistently beating the market is challenging due to market efficiency. Emphasizing time in the market over timing the market, the portfolio aligns with the principles of strategic partnership and sustainable growth.

The Key Components of the Boglehead 3 Fund Portfolio

The Boglehead 3 Fund Portfolio comprises US total stock market, total international stock market, and total bond market index funds. Each component offers exposure to specific global market segments and is designed to capture the entire global stock market and the US bond market. This construction aims to provide diversification, risk reduction, and long-term growth potential while enabling a balanced, low-maintenance investment approach.

Benefits of Using the Boglehead 3 Fund Portfolio

The Boglehead 3 Fund Portfolio presents a user-friendly, hands-off approach to investment management. It offers an inexpensive, diversified investment strategy suitable for both novice and seasoned investors. This portfolio streamlines the decision-making process, reducing the need for constant monitoring.

Its historical performance underscores its efficacy as a long-term investment strategy, highlighting reliable returns and minimized risk. The Boglehead 3 Fund Portfolio stands out as a cost-effective means to attain comprehensive market exposure with minimal oversight.

Simplicity and Ease of Management

The Boglehead 3 Fund Portfolio’s straightforward composition makes it easy for investors to comprehend and execute. With minimal ongoing management requirements, it reduces the time and effort for portfolio upkeep, appealing to individuals who prefer a hands-off investment strategy.

Its simplicity and ease of management render it accessible to a wide range of investors, allowing them to concentrate on long-term financial goals without being entangled in complex investment decisions.

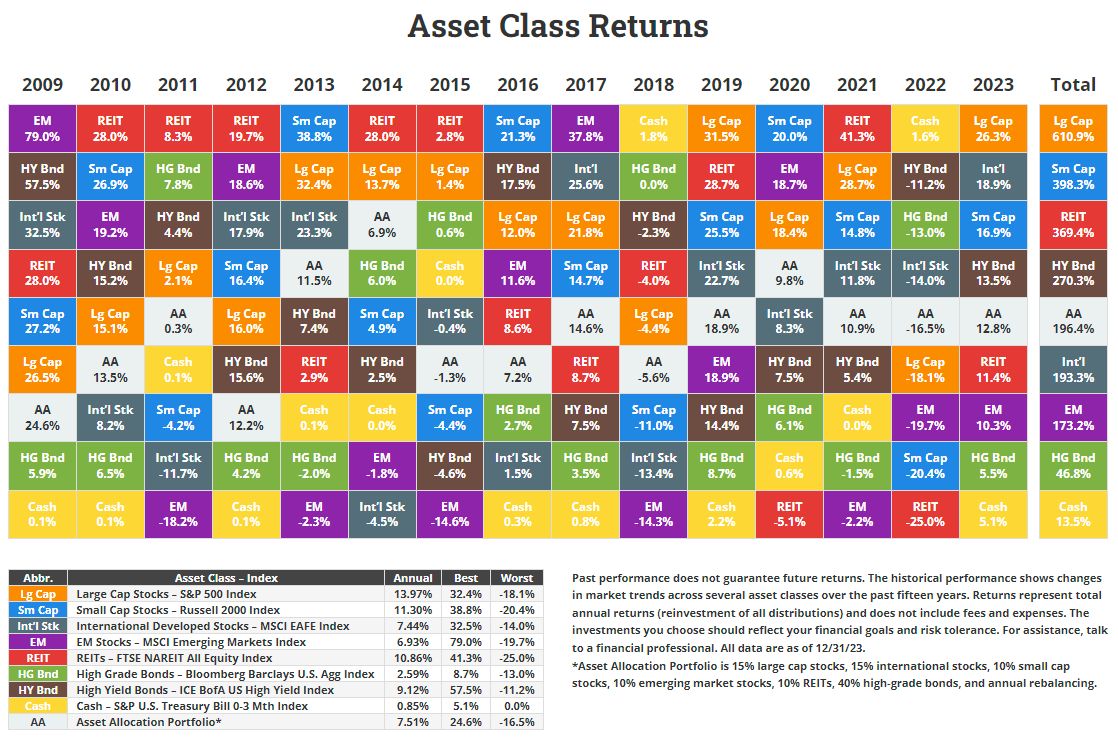

Diversification

A core tenet of the Boglehead 3 Fund Portfolio is its emphasis on broad diversification. This includes exposure to both domestic and international equities, as well as the bond market. Diversification plays a critical role in reducing overall portfolio risk by spreading investments across various asset classes and geographic regions.

Not only does this strategy aim to optimize risk-adjusted returns over the long term, but it also allows investors to capitalize on potential growth opportunities within global markets while mitigating the impact of individual market fluctuations.

Cost-effectiveness

The Boglehead 3 Fund Portfolio prioritizes cost-effectiveness by minimizing the impact of fees on investment returns. It focuses on low-cost, passively managed index funds with lower expense ratios, aiming to enhance long-term returns and preserve investor gains. This aligns with the Boglehead philosophy of reducing unnecessary costs and appeals to investors seeking a straightforward, low-cost solution with a focus on long-term value.

Implementing the Boglehead 3 Fund Portfolio in 2024

Implementing the Boglehead 3 Fund Portfolio in 2024 involves following a simple, low-cost investment strategy. It consists of three index funds covering the total stock market, total international stock market, and total bond market to maximize diversification and minimize expenses, aligning with the principles of John C. Bogle.

This passive investment approach is suitable for long-term, buy-and-hold investors, emphasizing the need for strategic partnership agreement and successful first cooperation.

The common Vanguard ETF’s are VTI, VXUS, and BND.

The Current Market Scenario and the Boglehead 3 Fund Portfolio

Amid current market volatility, the Boglehead 3 Fund Portfolio’s simplicity and low fees make it a fitting choice. Its diversified structure helps mitigate risk, especially in uncertain economic times, thanks to its stable bond allocation. The passive nature of the strategy aligns well with the slow economic recovery post-pandemic, appealing to investors seeking a straightforward, hands-off approach amidst market unpredictability. This portfolio presents a compelling option for those looking for stability and long-term growth opportunities.

Best ETF’s to Use for Implementation

When implementing the Boglehead 3 Fund Portfolio, popular ETFs like VTI: Vanguard Total Stock Market ETF, VXUS: Vanguard Total International Stock ETF, and BND: Vanguard Total Bond Market ETF are commonly utilized.

These ETFs offer comprehensive exposure, low expense ratios, and a history of reliable tracking performance. Additionally, their liquidity supports efficient buying and selling of fund shares, facilitating easy rebalancing and cost-effective portfolio construction. The combination of these three ETFs provides a well-rounded, diversified investment foundation.

Comparing the Boglehead 3 Fund Portfolio with Other Investment Strategies

Evaluating the Boglehead 3 Fund Portfolio against other investment strategies offers valuable insights for investors. Understanding the distinctions between the Boglehead 3 Fund Portfolio and alternative approaches provides a comprehensive perspective. By contrasting different strategies, investors can make informed decisions aligned with their financial objectives. This assessment is crucial for optimal decision-making and aids in understanding the unique features and potential advantages of the Boglehead approach. Assessing the compatibility of various strategies with individual investment preferences is essential for informed investment decisions.

Boglehead 3 Fund Portfolio vs. Active Investing

When comparing the Boglehead 3 Fund Portfolio with active investing, it’s essential to highlight the differences in investment philosophy. The Boglehead approach emphasizes passive, low-cost investing, while active investing involves ongoing management and higher fees. Investors can weigh the trade-offs between potential outperformance and cost efficiency in these two approaches, facilitating a well-informed selection of the most suitable investment strategy. Understanding the implications of active decision-making versus a more hands-off strategy is essential for portfolio construction.

Boglehead 3 Fund Portfolio vs. Other Lazy Portfolios

A comparative analysis of the Boglehead 3 Fund Portfolio with other lazy portfolios reveals distinct asset allocations and characteristics. Understanding these differences aids in identifying the most suitable investment strategy and aligning investment preferences with portfolio structure. Evaluation of risk-return trade-offs guides investors in selecting an optimal long-term investment solution. Recognizing unique attributes of the Boglehead 3 Fund Portfolio within the context of lazy portfolios supports informed investment decisions. This comprehensive perspective assists in making well-informed selection of the most suitable investment strategy.

Step-by-Step Guide to Getting Started with the Boglehead 3 Fund Portfolio

A structured approach streamlines the initiation of the Boglehead 3 Fund Portfolio for novices. Each step furnishes crucial insights for a successful embarkation into the realm of investments. This comprehensive guide ensures a deep comprehension of the Boglehead 3 Fund Portfolio, providing new investors with a clear roadmap to follow. By adhering to this systematic approach, individuals can gain confidence in implementing the portfolio.

Step 1: Understanding Your Financial Goals

Identifying and comprehending financial goals marks the initial and pivotal phase in the investment process. This step underscores the importance of aligning the Boglehead 3 Fund Portfolio with individual financial aspirations, emphasizing a strategic approach tailored to specific objectives. Understanding personal financial goals is fundamental for crafting a customized and successful investment strategy, laying a sturdy foundation for a purposeful investment journey. Clear definition of financial goals forms the bedrock for a well-informed and effective investment strategy.

Step 2: Choosing the Right ETF’s

Selecting the most suitable ETFs is a crucial decision when creating the Boglehead 3 Fund Portfolio. This step emphasizes the significance of thorough research and careful consideration in choosing ETFs. It provides essential insights into identifying the most appropriate ETFs to ensure a well-structured and diversified investment plan, which forms the cornerstone of a successful Boglehead 3 Fund Portfolio. Careful evaluation of ETF options is pivotal in constructing a robust and balanced investment strategy.

Step 3: Implementing the Portfolio

Effectively integrating the chosen ETFs into the investment portfolio is vital for successful execution. This step emphasizes systematic and strategic implementation to ensure a well-structured investment strategy. The seamless integration of selected ETFs sets the stage for long-term growth and stability, laying the groundwork for reliable yields and optimal plant growth. Implementing the Boglehead 3 Fund Portfolio requires careful execution, essential for the profitability of wind power projects, regional development, and real estate developments.

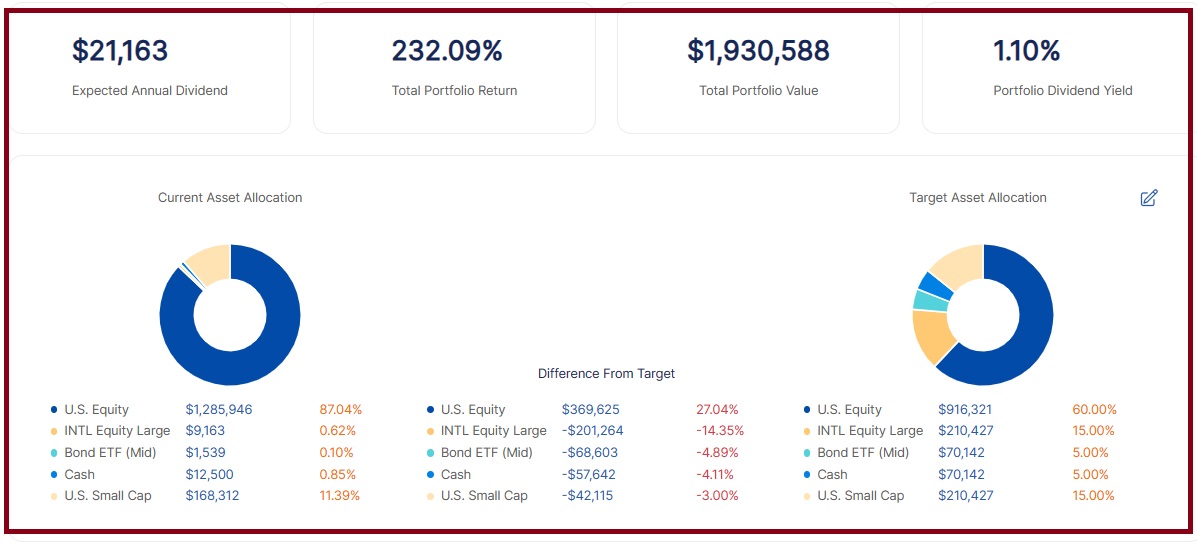

Step 4: Periodic Review and Rebalancing

Regularly reviewing and rebalancing the portfolio is crucial for sustaining its optimal performance. This step underscores the importance of ongoing monitoring and adjustments in the investment journey. It emphasizes a proactive approach to ensure continued success and growth, contributing to the sustainability of the Boglehead 3 Fund Portfolio. A disciplined approach to review and rebalance enhances the portfolio’s resilience and long-term performance.

Adapting the Boglehead 3 Fund Portfolio to Your Personal Circumstances

Understanding the adaptability of the Boglehead 3 Fund Portfolio is crucial for tailoring it to individual circumstances. This customization fosters a sense of ownership and confidence, aligning the portfolio with specific financial goals and time horizons. Adapting the portfolio ensures a purposeful and effective investment strategy, facilitating a personalized and sustainable investment plan. The flexibility of the portfolio allows investors to systematically customize it based on age, risk tolerance, and other personal circumstances, contributing to reliable yields and long-term growth.

Adapting for Age and Risk Tolerance

Adapting an investment portfolio based on age and risk tolerance is crucial for a well-suited strategy. It underscores the importance of aligning the portfolio with individual risk preferences and life stage. Tailoring the portfolio based on age and risk tolerance ensures a prudent and strategic approach to investment, enabling informed decision-making and contributing to a resilient and personalized investment plan. This approach emphasizes the significance of understanding the impact of age and risk tolerance on the portfolio, fostering a balanced and tailored investment strategy.

Adapting for Financial Goals and Time Horizon

Align your investments with financial objectives, considering the time horizon for goal achievement. Adjust the portfolio according to risk tolerance and regularly realign it with changing goals. Monitor performance in relation to your time horizon.

Expert Tips for Maximizing Returns with the Boglehead 3 Fund Portfolio

Utilize systematic creativity in dollar-cost averaging for optimal plant growth and reliable yields. Maintain discipline to avoid impulsive decisions amidst growing population and traffic jams. Focus on long-term strategy amidst local public transport developments and regional economic affairs. Periodically rebalance the portfolio to meet the terms of aesthetics and profitability of wind power projects. Seek professional advice for successful first cooperation in strategic partnerships, maximizing returns through innovative products.

Tip 1: Emphasizing Regular Investments

Emphasize regular contributions to the portfolio to capitalize on compounding benefits. Automate investments for convenience and consistency, prioritizing systematic planning for long-term wealth accumulation. Regularly monitor portfolio performance for informed adjustments.

Tip 2: Avoiding Emotional Investing Decisions

Base your investment decisions on thorough research and analysis, steering clear of emotional influences. Refrain from impulsive reactions to short-term market fluctuations and instead, adopt a disciplined approach to investing that is independent of emotions. Prioritize understanding the rationale behind investment decisions before execution, minimizing the impact of emotional bias in the decision-making process. By implementing these strategies, you can maintain a rational and informed approach to investment, free from the influence of fleeting emotions.

Tip 3: Sticking to the Plan Despite Market Fluctuations

Maintain a steadfast commitment to the long-term investment strategy and resist the urge to deviate from the predetermined investment plan. Acknowledge the inevitability of market fluctuations and remain resolute, staying focused on the overarching financial goals despite transient market movements. Review, reassess, and realign the investment plan, if necessary, without emotional interference. It’s essential to stay disciplined and avoid emotional investing decisions, ensuring that your investment strategy remains aligned with your long-term objectives.

Is the Boglehead 3 Fund Portfolio the Right Choice for You?

Considering your investment needs and goals, evaluating the alignment of the Boglehead 3 Fund Portfolio is crucial. Assess its diversification, risk management, and historical performance in different market conditions. Seek professional guidance to determine its appropriateness for your financial situation.

Assessing Your Investment Needs and Goals

To determine your investment needs, rank your short-term and long-term objectives. Align your risk tolerance with these goals and consider the time horizon for achieving them. Assess the compatibility of the Boglehead 3 Fund Portfolio with your unique needs, and seek professional advice to tailor the portfolio to your specific financial goals and time horizon.

Conclusion

In conclusion, the Boglehead 3 Fund Portfolio offers several benefits for beginners looking to invest in a simple and cost-effective manner. The portfolio’s emphasis on diversification, ease of management, and low costs make it an attractive option.

Additionally, historical performance suggests that the portfolio has delivered solid returns over time. However, it is important to consider the risks associated with market fluctuations, inflation, and rebalancing.

Comparisons with other investment strategies highlight the advantages of the Boglehead 3 Fund Portfolio.

To get started, assess your financial goals and choose the right ETFs. Regular review and periodic rebalancing are crucial for maintaining the portfolio’s effectiveness. By following expert tips and adapting the portfolio to your personal circumstances, you can maximize returns.

Ultimately, whether the Boglehead 3 Fund Portfolio is the right choice for you depends on your individual investment needs and goals.