Essential Guide to Backdoor Roth 2024 Contributions

Welcome to the essential guide to backdoor Roth 2024 contributions. In this comprehensive blog, we will delve into the concept of backdoor Roth IRAs, understand the mechanism behind them, compare them to traditional IRAs, and explore the key steps to implement a backdoor Roth IRA.

We will also discuss the tax implications of backdoor Roth IRAs, the legal status of these contributions in 2024, and the advantages and disadvantages of utilizing this strategy for retirement savings. Additionally, we will explore alternatives to backdoor Roth IRAs, help you decide if this strategy is right for you, and provide answers to frequently asked questions. Let’s dive in and explore the world of backdoor Roth IRAs.

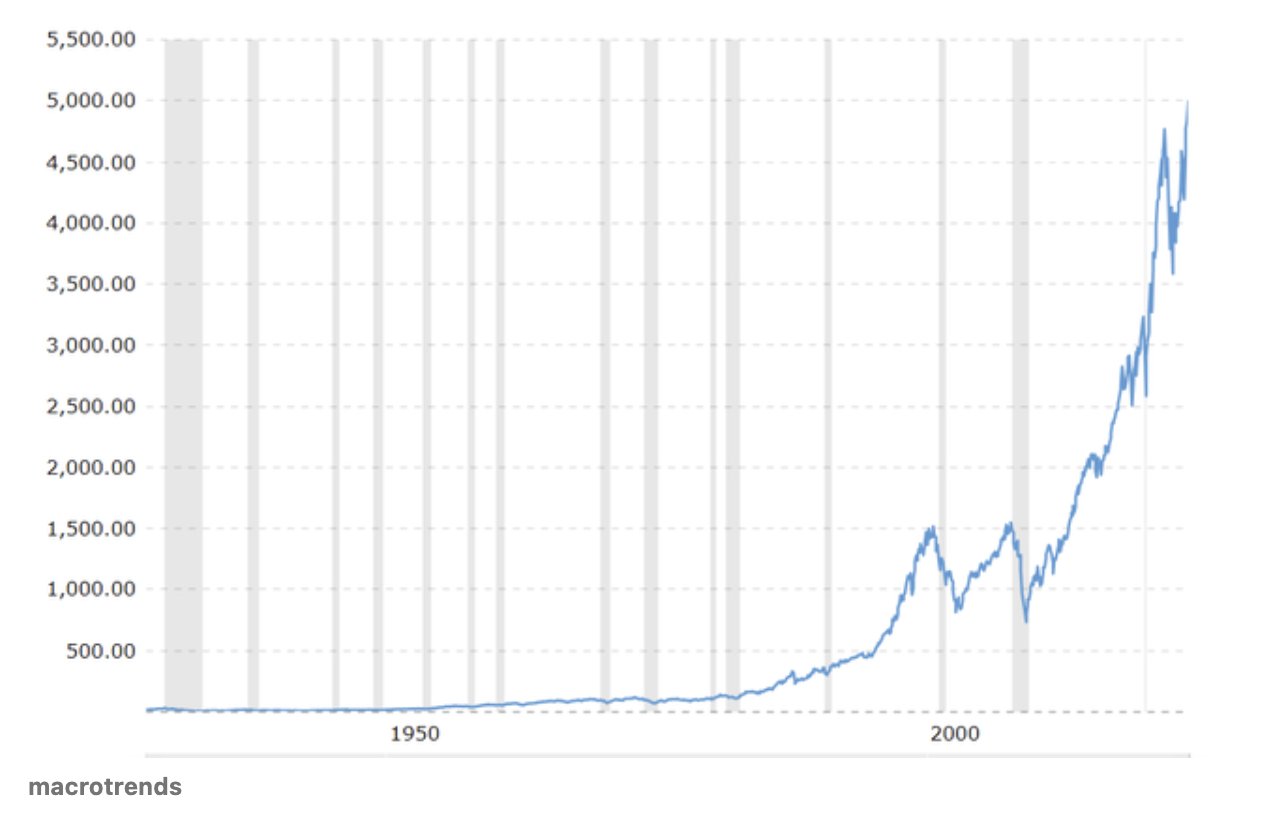

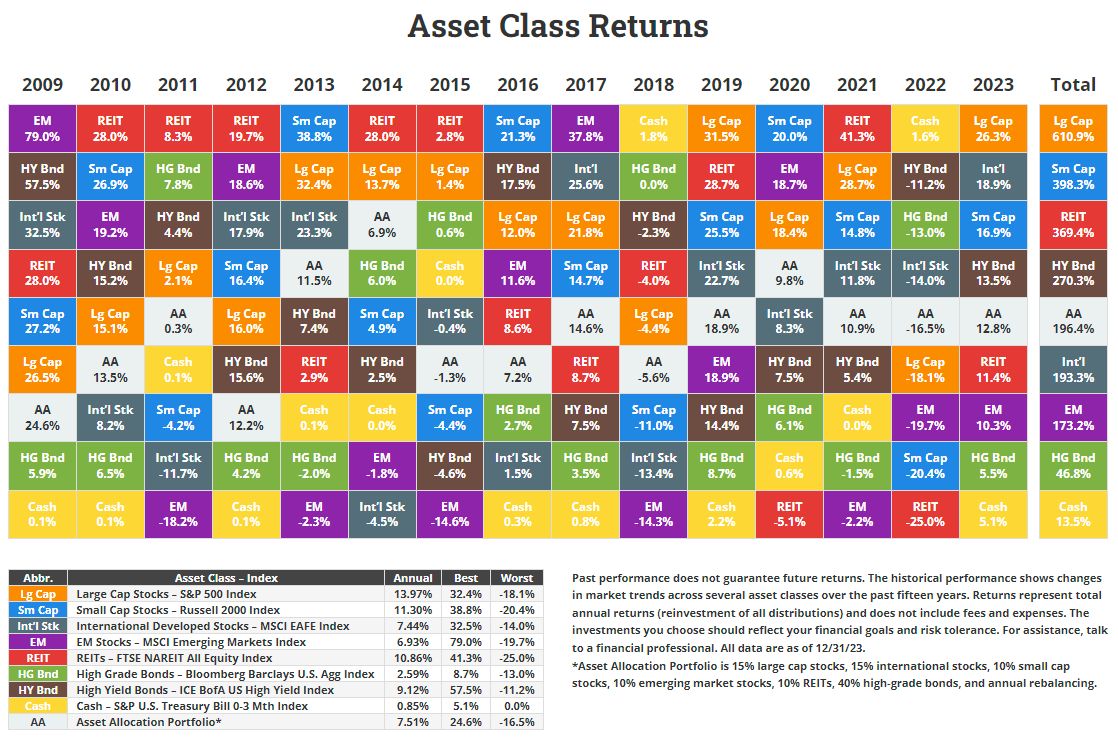

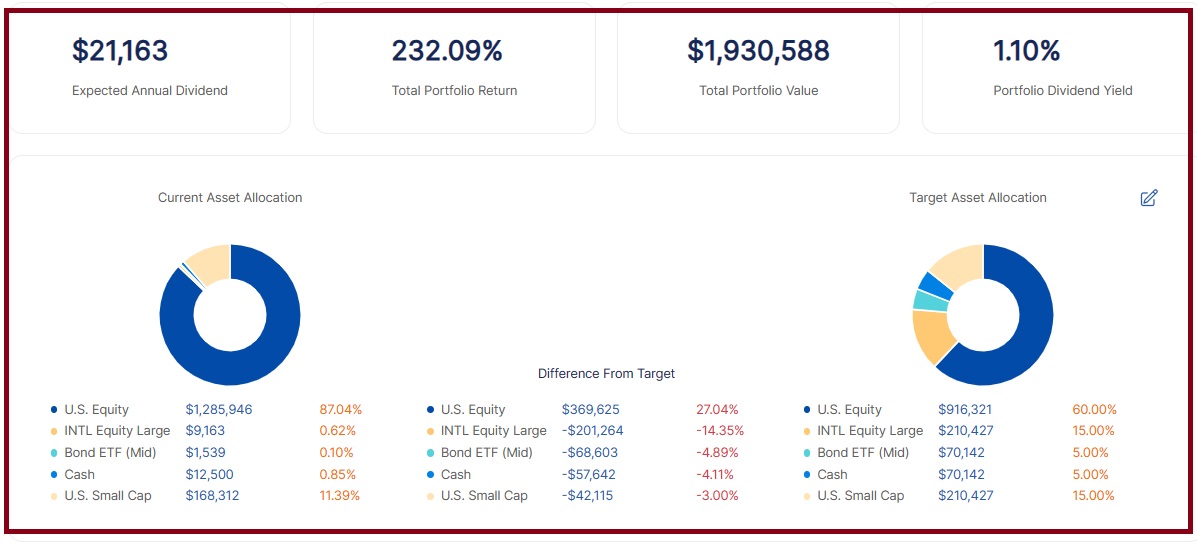

At AssetRise we believe in the Vanguard Bogleheads principles of Index Investing. The AssetRise tool provides portfolio rebalancing, dividend projections, and portfolio return for all your investment accounts in a single dashboard. Add 2 accounts for free.

Understanding the Concept of Backdoor Roth IRA

A backdoor Roth IRA is a strategy that high earners can use to contribute to a Roth IRA, even if they exceed the income limits for direct Roth contributions. The idea behind the backdoor Roth strategy is to make a non-deductible contribution to a traditional IRA and then convert the funds to a Roth IRA. By doing this, high earners can benefit from the advantages of a Roth IRA, such as tax-free growth and tax-free withdrawals in retirement. This strategy allows individuals to build their retirement savings in a tax-efficient manner, regardless of their income level.

The Mechanism of a Backdoor Roth IRA

The process of implementing a backdoor Roth IRA involves making a non-deductible contribution to a traditional IRA and then converting the funds to a Roth IRA. Let’s break down the key steps involved:

- Make a contribution to a traditional IRA: High earners who exceed the income limits for direct Roth contributions can still make contributions to a traditional IRA. However, since these contributions are non-deductible, they do not offer immediate tax benefits.

- Convert the traditional IRA to a Roth IRA: After making the contribution to the traditional IRA, the next step is to convert the funds to a Roth IRA. This conversion involves transferring the money from the traditional IRA to the Roth IRA.

- Report the conversion on your tax return: When you convert funds from a traditional IRA to a Roth IRA, it is important to report the conversion on your tax return. The converted funds are considered taxable income, so you will owe taxes on the converted amount at your current income tax rate.

- Track and document all transactions for tax purposes: To ensure compliance with tax laws and maintain accurate records, it is crucial to track and document all backdoor Roth IRA transactions. This includes documentation of the contributions made to the traditional IRA, the conversion to the Roth IRA, and any tax reporting related to the conversion.

- Consult a financial advisor or tax expert for personalized advice: Implementing a backdoor Roth IRA strategy can be complex, especially when considering individual financial circumstances and tax implications. It is highly recommended to consult a financial advisor or tax expert who can provide personalized advice based on your specific situation.

- The backdoor Roth strategy offers a tax-efficient way for high earners to build their retirement savings, taking advantage of Roth IRA benefits that include tax-free growth and tax-free withdrawals in retirement. However, it is important to understand the contribution limits, conversion process, tax obligations, and any legal considerations involved. Consulting with a financial advisor or tax professional can help ensure that the backdoor Roth strategy is implemented correctly and in line with your overall financial goals.

Comparing Roth IRAs and Traditional IRAs

Before diving deeper into the backdoor Roth strategy, let’s compare Roth IRAs and traditional IRAs. Both of these retirement accounts offer unique benefits, but they differ in terms of contributions, tax treatment, and required minimum distributions.

Roth IRA: With a Roth IRA, contributions are made with after-tax dollars, meaning that you don’t get an upfront tax deduction. However, the funds in a Roth account grow tax-free, and qualified withdrawals in retirement are tax-free as well. One of the significant advantages of Roth IRAs is that there are no required minimum distributions (RMDs) during the account holder’s lifetime, allowing the funds to continue growing tax-free.

Traditional IRA: Contributions to a traditional IRA may be tax-deductible, depending on income, filing status, and participation in an employer-sponsored retirement plan. However, the funds in a traditional IRA grow tax-deferred, meaning you’ll pay taxes on distributions in retirement. Unlike Roth IRAs, traditional IRAs require minimum distributions starting at age 72, which can impact retirement income planning.

The backdoor Roth strategy leverages the benefits of both Roth and traditional IRAs. By making non-deductible contributions to a traditional IRA and then converting the funds to a Roth IRA, high earners can enjoy tax-free growth, tax-free withdrawals in retirement, and the ability to avoid required minimum distributions.

This strategy provides tax diversification, as it allows individuals to hold both traditional and Roth accounts to better manage taxable income in retirement. It is important to consider the tax impact of conversion, any existing traditional IRAs, and the specific situation of each individual when evaluating the backdoor Roth strategy as part of a retirement savings plan.

Key Steps to Implement a Backdoor Roth IRA

Implementing a backdoor Roth IRA involves several key steps that high earners should follow to maximize the benefits of the strategy. Let’s explore the essential steps to implement a backdoor Roth IRA in 2024.

Step-by-step Procedure

To begin the process, contribute funds to a traditional IRA. Next, execute the conversion from a traditional IRA to a Roth IRA. Subsequently, report this conversion on your tax return accurately. Keep detailed records of all transactions for tax purposes. Seek guidance from a financial advisor or tax expert for personalized recommendations. Ensure to follow these steps diligently to maximize the benefits of the backdoor Roth strategy and make the most of potential tax savings and retirement income.

Avoiding Common Mistakes

To steer clear of pitfalls when managing your Backdoor Roth IRA, it’s crucial to be mindful of potential penalties stemming from overcontributions. Accurate reporting of conversions on tax returns is paramount to ensure compliance with IRS regulations. Keep a close eye on the timing of contributions and conversions. Seeking guidance from a professional can help navigate the intricate web of tax implications associated with this strategy. Stay abreast of any alterations in tax laws that could impact the efficacy of your Backdoor Roth approach.

Tax Implications of Backdoor Roth IRA

Understanding the tax implications of a Backdoor Roth IRA is crucial for financial planning. When considering a roth conversion, individuals need to evaluate the impact on tax dollars. It’s essential to plan strategically and involve the plan administrator for seamless execution. Implementing the mega backdoor roth strategy can maximize employer contributions and boost retirement savings. By understanding roth ira income limits and optimizing contributions, one can grow their nest egg efficiently. Assessing how much money to convert and taking advantage of employer match can optimize tax benefits and retirement income. Consider your specific situation, gross income, tax filing status, and traditional IRA distributions to achieve significant tax savings in a given year.

Roth Conversion Tax Rules

Understanding the tax implications of a roth conversion is crucial when considering a backdoor Roth IRA strategy. Tax dollars are owed on the amount converted from a traditional to a Roth IRA at your current income tax rate. Depending on your tax filing status and given year, higher tax brackets may lead to significant tax bills upon conversion. It’s essential to grasp how the timing of the conversion impacts tax obligations for optimal tax benefit. Consulting with a tax professional can help navigate the complexities of tax rules and ensure you make the best decisions for your specific situation.

Tax Benefits of Backdoor Roth IRA

Enjoy tax-free growth and qualified withdrawals during retirement with Roth IRAs. High earners can leverage the Backdoor Roth strategy for Roth benefits. Roth IRAs offer potential for tax-free legacy planning. Achieve tax diversification by balancing traditional and Roth accounts. Utilize a backdoor Roth for tax flexibility in retirement without limitations. Maximize tax benefits through strategic roth conversion plans. Plan administrator can guide on mega backdoor roth strategy for employer contributions. Consider employer match impact on roth IRA income limits. Optimize nest egg growth with employer contributions and tax deductions for significant tax savings.

Is a Backdoor Roth IRA still allowed in 2024?

Legal Status of Backdoor Roth IRA

Considering tax laws, a backdoor Roth IRA involves transferring funds from a traditional IRA to a Roth IRA, enabling contributions without income limitations. This knowledge is crucial for individuals contemplating backdoor Roth contributions, subject to yearly contribution caps.

Recent Changes in Legislation

Recent legislative changes play a pivotal role in backdoor Roth IRA planning strategies. Keeping abreast of alterations in tax laws is essential for optimizing backdoor Roth approaches. Understanding the tax implications stemming from legislative modifications is crucial to navigate the contribution landscape of Roth IRAs effectively. Recent updates can influence the permissible ways individuals contribute to their Roth IRAs, necessitating expert advice from financial planners to decipher any changes accurately.

Advantages and Disadvantages of a Backdoor Roth IRA

Exploring the benefits and drawbacks of utilizing a Backdoor Roth IRA entails considering various factors. When contemplating the advantages, individuals often focus on potential significant tax savings through a roth conversion. On the flip side, it’s crucial to acknowledge the impact on tax dollars, especially concerning traditional IRA distributions. One key advantage is the flexibility to decide when to convert and how much money to convert, depending on your specific situation. In contrast, individuals must be mindful of the tax implications based on their retirement income and gross income in a given year. Understanding these nuances can help individuals make informed decisions about their financial future.

The Upsides of a Backdoor Roth IRA

High-income earners find a strategic advantage in utilizing a Backdoor Roth IRA, enabling contributions even if direct contributions aren’t an option. The allure lies in the potential for tax-free growth and withdrawals during retirement, offering a nest egg with significant tax benefits. What sets it apart is the absence of mandatory minimum distributions at age 72, giving flexibility in managing retirement income. Moreover, it serves as a valuable tool for tax diversification, ensuring tax dollars are optimized across various retirement accounts. Adhering to specific guidelines and rules when implementing a roth conversion can lead to substantial tax savings and long-term financial benefits.

The Downsides of a Backdoor Roth IRA

While considering a Backdoor Roth IRA, one significant drawback lies in the contribution limits. The annual cap for a Roth IRA, standing at $6,000 or $7,000 for individuals aged 50 and above, applies to both traditional and backdoor Roth inputs. This could restrict your total contributions if you’ve already funded a traditional IRA. Moreover, the tax implications are worth noting; while traditional IRA contributions are tax-deductible, those for a Roth IRA aren’t, resulting in tax payments on converted funds. Additionally, the pro-rata rule necessitates treating all traditional IRAs collectively during a conversion, affecting tax efficiency, alongside IRS scrutiny, potential audits, and the intricate nature of backdoor Roth processes.

Alternatives to Backdoor Roth IRA

Exploring other retirement savings options beyond the Backdoor Roth IRA can offer flexibility in tax planning. One option is the Mega Backdoor Roth strategy, which allows for substantial after-tax contributions to a 401(k) plan. Employers’ matching contributions and plan administrators play critical roles in optimizing this strategy. Additionally, considering traditional IRAs and other investment avenues can provide a diversified approach to building your nest egg. Assessing your specific situation, including income limits and employer matches, is essential for determining the best way to grow your retirement income. Evaluating alternatives alongside the Backdoor Roth IRA can lead to maximizing tax benefits and ensuring significant tax savings in the long term.

Mega Backdoor Roth IRA

Exploring the Mega Backdoor Roth IRA unveils a strategic financial move distinct from traditional Roth IRAs. It offers substantial advantages, particularly catering to high-income individuals seeking additional tax benefits. Delving into 2024 contributions, a detailed roadmap guides one through the process, emphasizing crucial factors and potential pitfalls to navigate successfully. Noteworthy is the Mega Backdoor Roth IRA’s unique feature enabling larger contributions and promising significant tax savings, positioning it as an enticing option for maximizing retirement funds efficiently.

Traditional IRA and Other Investment Options

Exploring retirement savings beyond traditional IRA contribution limits and income thresholds is crucial. Considering 401(k) plans, Roth IRAs, and the advantageous roth conversion can optimize tax dollars and retirement income. Implementing a mega backdoor roth strategy, along with employer contributions and matching, can boost your nest egg significantly. It’s important to weigh the benefits in your specific situation to maximize tax benefits and gross income. Understanding the timing of traditional IRA distributions and Roth IRA conversions ensures a seamless transition for significant tax savings. Consulting a tax professional can help tailor the best way to grow your retirement funds effectively.

Deciding if a Backdoor Roth IRA is Right for You

Determining the suitability of a Backdoor Roth IRA revolves around financial considerations and retirement objectives. Assessing factors like tax implications, expected retirement income, and employer contributions is crucial. Understanding how a Roth conversion impacts your tax filing status and gross income helps in making an informed decision. Evaluating if a Backdoor Roth IRA aligns with your specific situation and retirement goals is paramount. Considering the potential tax benefits and long-term savings plays a vital role. Analyzing traditional IRA distributions, employer matches, and the best way to maximize your nest egg aids in the decision-making process.

Financial Factors to Consider

When considering a Backdoor Roth IRA, financial factors play a crucial role in decision-making. Evaluating your roth conversion strategy is essential to maximize tax benefits and savings. Understanding the tax implications can help in planning for tax dollars effectively. Consulting with your plan administrator about mega backdoor roth strategy can optimize employer contributions and align with your retirement goals. Analyzing Roth IRA income limits is necessary to ensure compliance and growth of your nest egg. Assessing the best way to utilize IRA funds based on your specific situation can lead to significant tax savings and building a substantial retirement income.

Retirement Goals and Objectives

Setting precise retirement objectives serves as a compass for financial choices. Evaluating your current financial status is pivotal for aligning with retirement aspirations. Periodically revising and adapting retirement schemes is essential amid changing situations. Pinpointing investment tactics that bolster long-term retirement targets is crucial. Striving towards building a varied retirement portfolio enhances financial security.

Frequently Asked Questions

Popular Queries about Backdoor Roth IRA

What are the common inquiries about utilizing a Backdoor Roth IRA? Questions revolve around eligibility, contribution limits, taxes, and the conversion process. Learn about the advantages over traditional retirement accounts and seek clarity on timing, financial advice, and account compatibility for informed decisions.

What’s next after setting up a Backdoor Roth IRA?

After establishing a Backdoor Roth IRA, consider yearly contributions to a traditional IRA. Convert these funds to a Roth IRA by transferring them. Adhere to IRS regulations diligently. Seek advice from a financial planner for proper management and tax law compliance.

Strategies for Maximizing Your Roth IRA Contributions

Maximize your Roth IRA contributions by reaching the IRS’s annual limit. Explore catch-up contributions for those above 50. Employ strategies like consistent investing through dollar-cost averaging. Regularly assess and adjust your investment portfolio to align with retirement objectives.

How Can High Earners Benefit From Backdoor Roth IRA?

Maximize benefits with a Backdoor Roth IRA by contributing nondeductible amounts to a traditional IRA, then converting to a Roth. High earners enjoy tax-free growth and withdrawals in retirement, leveraging the absence of income limits for contributions. Consult a financial advisor for IRS compliance and optimization.

Conclusion

In conclusion, understanding the intricacies of Backdoor Roth IRA contributions is essential for maximizing your retirement savings. By following the right steps and avoiding common pitfalls, you can take advantage of the tax benefits it offers. Consider the legal implications and recent legislative changes to make informed decisions. While weighing the advantages and disadvantages, assess if it aligns with your financial goals.

Explore alternatives like Mega Backdoor Roth IRA or traditional IRAs based on your needs. Ultimately, thorough research and thoughtful planning will help you determine if a Backdoor Roth IRA is the right choice for your financial future.

Add your first 2 portfolios for FREE. AssetRise provides the industry leading portfolio rebalance calculator.