This blog weighs the benefits of Mutual Funds vs. Vanguard ETF funds like VTI, BND, and VXUS. These ETF funds are the foundations for a Boglehead 3 Fund Portfolio.

ETF’s and Mutual Funds are the pillars of a Boglehead, Vanguard, or FIRE investor as they provide a diversified low cost asset allocation to investing. ETF’s are more recent while Mutual Funds have been around for decades.

We recommend understanding the Bogleheads Guide to Investing along with the differences in ETF’s and Mutual Funds as keys to success in your investment journey.

ETF Funds vs. Mutual Funds: Which To Choose

Investing in mutual funds or exchange-traded funds (ETFs) can be an excellent way for beginners and seasoned investors to build wealth. But, how do you choose between the two?

In this blog, we’ll compare ETFs and mutual funds, highlight their similarities and differences, and help you decide which investment vehicle is right for you. We’ll also dive into topics like active versus passive management, fund returns and costs, risk assessment, and portfolio management tools.

By the end of this guide, you’ll have a better understanding of the pros and cons of each investment option so that you can make an informed decision about your portfolio.

Understanding Exchange Traded Funds (ETFs)

ETFs enable investors to achieve diversified exposure to a specific market index and trade like stocks on a stock exchange, providing liquidity and flexibility. The net asset value of an ETF is calculated at the end of each trading day based on the market price of its securities. These funds can be a better choice for tax advantages and are generally more tax-efficient than shares of a mutual fund. Understanding the right funds and types of funds is essential for making informed investment decisions.

Basics of ETFs

ETFs present a diversified portfolio of assets like stocks, bonds, or commodities. Investors benefit from owning fractional shares of a portfolio comprising hundreds or thousands of individual securities, providing diversification. They typically offer a lower expense ratio compared to mutual funds, making them cost-effective. An ETF’s market price closely aligns with its net asset value, avoiding significant premiums or discounts. They are a suitable option for investors who prefer independent decision-making based on market analysis.

The Structure and Performance of ETFs

ETFs offer investors a better choice due to their transparent pricing and flexibility. Authorized participants create or redeem shares of an ETF in creation units, ensuring market price alignment with net asset value. While most ETFs are passively managed, actively managed options are available, broadening the types of funds accessible to investors. Additionally, ETFs provide exposure to various asset classes, such as stock market, bonds, and commodities, allowing for diversification within a single investment.

Advantages and Disadvantages of ETFs

ETFs provide investors with the flexibility to trade throughout the day, ensuring liquidity and potential price improvement. Their tax efficiency can lead to lower capital gains distributions than mutual funds. However, they come with additional risks due to market volatility from being actively traded. Investors should be mindful of brokerage commission fees that may impact overall returns. ETFs also offer diverse investment strategies, including specific sector and market segment options, making them a better choice for those seeking tailored investments.

Deciphering Mutual Funds (MFs)

Mutual funds combine investments in stocks, bonds, and other securities from a group of investors to achieve specific objectives. Their shares are valued based on NAV, calculated using closing security prices. Actively managed by a fund manager, they aim to outperform a benchmark. Mutual funds offer the option to reinvest dividends and consider the expense ratio. This allows for compounding returns over time, making them a better choice for diversifying within a single investment.

Fundamentals of Mutual Funds

Investors can gain exposure to a diversified portfolio of securities with relatively small investments in mutual funds. These funds are a good choice for individuals seeking professional management and active decision-making without directly managing their portfolios. The net assets of a mutual fund represent the total market value of all the securities, cash, and other assets held by the fund, minus any liabilities. They are an important consideration for diversifying across various asset classes, including stocks, bonds, and money market instruments. The prospectus provides essential information about the fund’s investment objectives, risks, fees, and historical performance data.

How do Mutual Funds Work?

Mutual funds offer a range of investment options to suit different needs. You can buy their shares directly or through a brokerage firm, making them accessible to individual investors. With the flexibility of daily trading, mutual funds allow you to gain exposure to various securities and receive dividends for income or reinvestment.

Pros and Cons of Investing in Mutual Funds

Investing in mutual funds provides access to a diversified portfolio of securities across various asset classes, spreading investment risk. The expertise of a fund manager optimizes investment performance through research, analysis, and decision-making. Investors should consider the expense ratio impacting returns and potential tax implications from capital gains distributions. Mutual funds suit long-term investors seeking capital appreciation and income generation.

ETFs vs. Mutual Funds: Key Similarities and Differences

Both ETFs and mutual funds offer investors diversified exposure to a portfolio of securities, even with a relatively small investment. They provide the option to reinvest dividends, capital gains, and other distributions, potentially enhancing investment returns. Both fund types allow exposure to various asset classes, including stocks and bonds, promoting diversification. However, mutual funds may subject investors to capital gains distributions, while ETFs are generally more tax-efficient. Additionally, both options offer fractional shares for diversified investing without a large initial investment.

The Common Ground between ETFs and MFs

Both ETFs and mutual funds provide investors with the opportunity to gain diversified exposure to a portfolio of securities, spreading investment risk across various asset classes and individual holdings. Both types of funds offer the ability to reinvest dividends, capital gains, and other distributions, potentially compounding investment returns over time. Additionally, they provide investors with a liquid investment option, as shares can be bought or sold at market price at the end of each trading day, offering exposure to a wide range of asset classes, including stocks, bonds, and other securities.

Distinctive Features that Set ETFs and MFs Apart

When considering ETFs vs mutual funds, it’s important to understand their differences in buying and selling, tax implications, and fees. ETFs are traded on a stock exchange, offering shares that can be bought and sold throughout the trading day, while mutual funds are bought and sold at the end of each trading day. Additionally, ETFs often have lower expense ratios, making them a better choice for passive investors, whereas mutual funds may have higher fees due to active management, catering to those who prefer active management.

Active Management vs. Passive Management in ETFs and MFs

Active management in ETFs and mutual funds involves the fund manager’s active investment decisions to outperform a specific benchmark index. On the other hand, passive management in ETFs and mutual funds aims to replicate a specific market index, offering diversification and low fees.

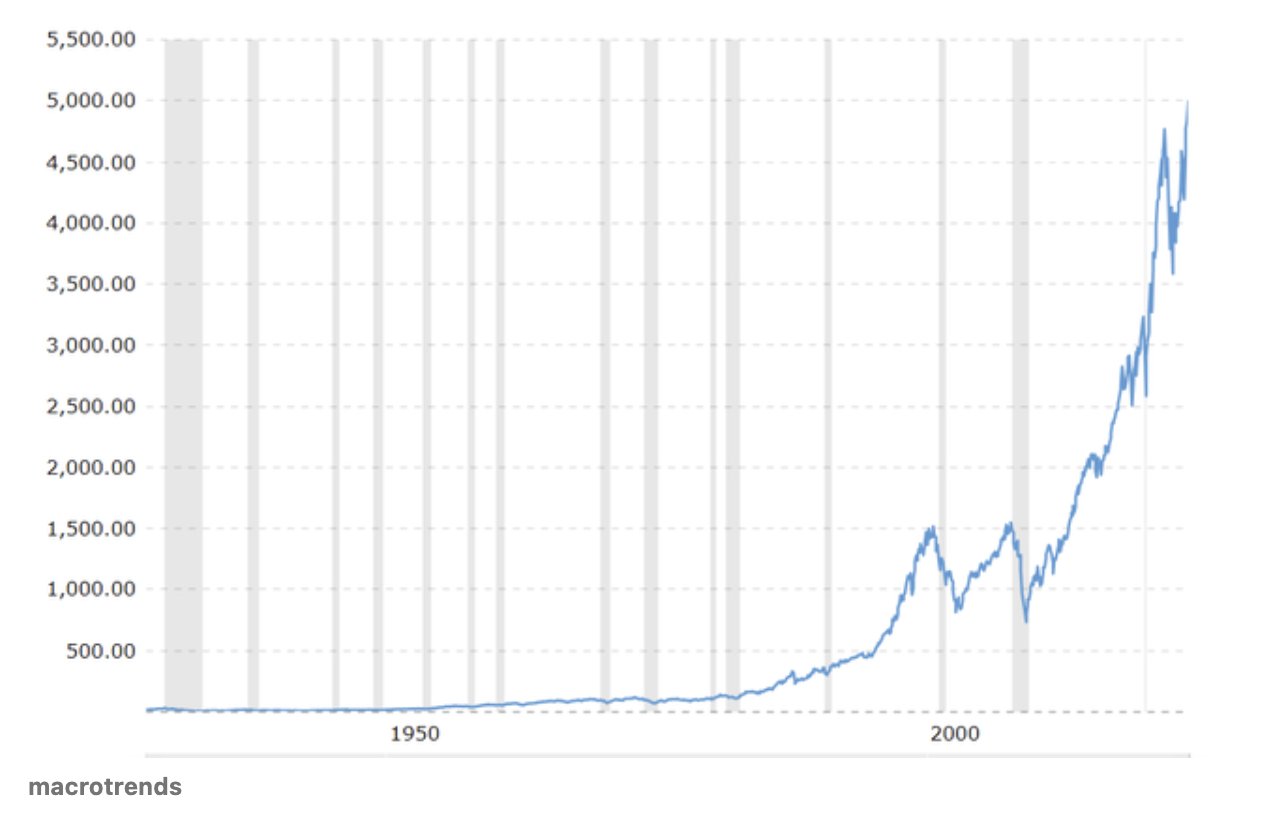

The Boglehead view is that active management is a form of “market timing” where an individual can outperform the market benchmark.

Active managers in mutual funds aim for higher returns by actively buying and selling individual securities, potentially resulting in higher fees for investors. Conversely, passive management in both ETFs and mutual funds is based on a buy-and-hold investment strategy, minimizing portfolio turnover. Investors should assess tax advantages, expense ratios, and investment strategies when deciding between active and passive management.

Boglehead investors rely on Passive Managed ETF and MF’s in the core portfolio as the data shows that active management cannot outperform the market for an extended period of time. You can read our in depth analysis of Boglehead investing including the Boglehead Guide To Investing.

Understanding Active Management

Active management in mutual funds involves the fund manager’s decisions to outperform a specific benchmark index, striving for higher capital gains. Such funds typically have higher expense ratios due to active research, investment decisions, and securities trading. Investors considering active management must weigh additional risks like underperformance, higher fees, and the fund manager’s choices. Frequent trading of individual stocks in active management can lead to higher capital gains distributions and affect tax implications, all based on the manager’s aim to outperform the market index.

Grasping the Concept of Passive Management

Passive management in ETFs and mutual funds involves replicating a specific market index to provide investors with a diversified portfolio and lower expense ratios. This strategy focuses on minimizing portfolio turnover, resulting in reduced capital gains distributions and tax implications. By tracking a market index, such as the S&P 500, with a diverse portfolio of holdings, passive management aims to offer market returns and long-term investment benefits. Investors can choose the right funds based on lower fees, reduced tax implications, and a buy-and-hold approach.

Comparing Active and Passive Management in ETFs and MFs

Active management in ETFs and mutual funds involves fund managers making investment decisions to outperform a specific benchmark index, potentially resulting in higher fees. On the other hand, passive management aims to replicate a specific market index, providing investors with a diversified portfolio, lower fees, and tax advantages. Investors must consider key differences, such as fees, investment strategies, and tax implications when choosing between ETFs and mutual funds. Passive management offers a long-term investment approach, lower expense ratios, and minimal portfolio turnover, benefiting investors.

Boglehead View of Active Management & Market Timing

Market timing refers to act(s) of investing based on the condition of the market as opposed to personal characteristics. Investopedia defines market timing as:

1. The act of attempting to predict the future direction of the market, typically through the use of technical indicators or economic data.

2. The practice of switching among mutual fund asset classes in an attempt to profit from the changes in their market outlook. Some investors, especially academics, believe it is impossible to time the market. Other investors, notably active traders, believe strongly in market timing. Thus, whether market timing is possible is really a matter of opinion. What we can say with certainty is that it’s very difficult to be successful at market timing continuously over the long-run. For the average investor who doesn’t have the time (or desire) to watch the market on a daily basis, there are good reasons to avoid market timing and focus on investing for the long-run.

For example, adjusting your asset allocation toward greater fixed income holdings because the bond market has lost value recently and there is an expectation of a bond market recovery would be an act of market timing. On the other hand, adjusting your asset allocation toward greater fixed income holdings because it is in your asset allocation plan to do so (for example, as you age), is not an example of market timing.

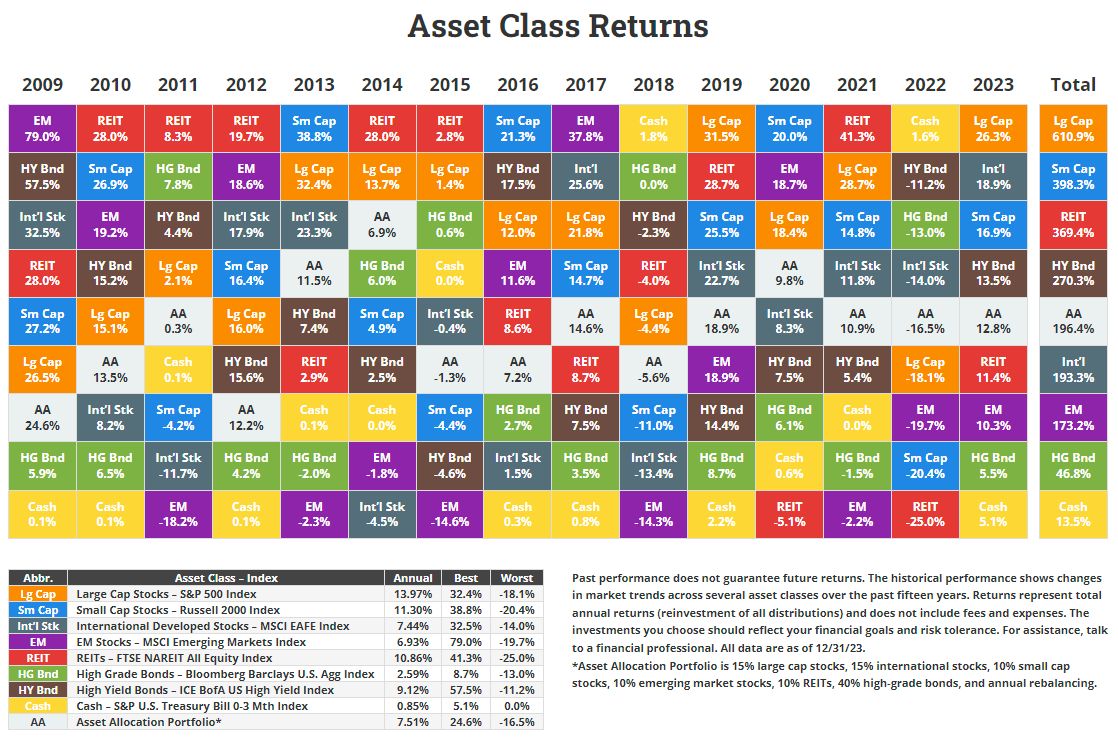

A Look at Fund Returns and Costs for ETFs and MFs

Fund returns for ETFs and mutual funds depend on market volatility, stock performance, and fund managers’ choices. Analyzing NAV, expense ratios, and capital gains helps investors understand associated costs. Returns in both types of funds reflect index performance, individual securities, dividends, and market volatility. Expense ratios, representing annual fees, impact investment decisions and net returns. Understanding costs like expense ratios and trading day implications is critical for evaluating fund returns.

An Analysis of Fund Returns

Fund returns in ETFs and mutual funds are influenced by market volatility, individual stock performance, dividends, and the fund manager’s investment decisions. Analyzing the net asset value (NAV) and market price provides investors with insights into fund returns and pricing mechanisms. ETF investors benefit from trading fractional shares, impacting fund returns and trading strategies. The benchmark index, dividends, and asset classes contribute to fund returns, providing an understanding of market performance and investment portfolio diversification. Evaluating fund returns includes considering fund expenses, dividends, market index performance, and the fund manager’s investment strategies.

Breaking Down the Associated Costs

Investors evaluating opportunities must understand the annual fees charged by the fund company, impacting net returns and investment decisions. Tax advantages, expense ratios, and trading day implications significantly impact the overall costs of investing in ETFs. On the other hand, mutual fund investors should evaluate capital gains distributions, net asset value (NAV), and expense ratios influencing total costs. Analyzing key differences in costs is essential for comparing ETFs and mutual funds.

Distributions from ETFs and Mutual Funds – What Should You Expect?

When it comes to distributions, ETF investors can expect tax advantages, lower expense ratios, and diversified portfolio holdings. On the other hand, mutual fund investors should anticipate capital gains distributions, expense ratios, and active management implications. Understanding the tax implications, expenses, and regulations is crucial for evaluating distributions from ETFs and mutual funds.

Understanding Distributions

Distributions from ETFs and mutual funds encompass dividends, capital gains, and expense ratios. These factors significantly impact investors’ taxable accounts and portfolio diversification. ETF investors can leverage tax advantages, lower expense ratios, and market index performance to inform their investment decisions. On the other hand, mutual fund investors should weigh capital gains distributions, expense ratios, and active management implications for informed investment strategies. Understanding these distribution differences is crucial for evaluating ETFs and mutual funds. Analyzing tax implications, investment strategies, and expense ratios is essential for comparing distributions from both types of funds.

Comparing Distribution Patterns of ETFs and MFs

When comparing distribution patterns of ETFs (exchange-traded funds) and mutual funds (MFs), it’s important to consider their differing approaches to distributing capital gains. Unlike MFs, ETFs are not subject to capital gains tax at the end of each trading day, leading to lower capital gains distributions. This is due to their unique creation and redemption process, which results in a more tax-efficient structure. Additionally, mutual funds may distribute capital gains more frequently than ETFs, impacting investors differently and influencing their investment decision-making process.

Risk Assessment: Are ETFs Safer Than Mutual Funds?

Evaluating the risks associated with ETFs is crucial for informed investment decision-making, while gauging the risk factor in mutual funds is essential for portfolio management. Understanding the risks involved in both options is vital for investors seeking a balanced and diversified portfolio. Assessing the safety of ETFs and mutual funds is a key consideration when deciding which investment option is right for you.

Evaluating Risks Associated with ETFs

Evaluating the risks of ETFs entails considering trading day price fluctuations, which expose investors to market volatility. Liquidity risks should be carefully evaluated, particularly during market volatility. Understanding ETF holdings is crucial for assessing risks and potential returns, along with evaluating the ETF net asset value. Additionally, the presence of derivatives in ETFs increases the importance of thorough risk assessment, making it an essential aspect of investment decision-making.

Gauging the Risk Factor in Mutual Funds

Assessing market volatility risks is crucial for informed decision-making by mutual fund investors. Understanding the net asset value of mutual funds is essential to grasp the associated investment risks. Evaluating the holdings of mutual funds is important for assessing diversification and potential risks. Investors’ tax implications and risk exposure are affected by capital gains distribution in mutual funds. The expense ratio of mutual funds plays a significant role in gauging the overall risk of the investment.

Making the Choice: ETF or Mutual Fund – Which is Right for You?

Considering investment company institute guidelines and tax advantages, as well as evaluating fund managers’ strategies, are crucial factors in choosing between ETFs and mutual funds. Additionally, the diversification benefits offered by both should be taken into consideration for an informed decision.

How to Decide Between ETFs and Mutual Funds?

When deciding between ETFs and mutual funds, understanding market index benchmarking is crucial. Consider differences in fund pricing and trading day market price, as well as assessing individual securities holdings. Evaluate the tax implications and conduct thorough research on fund companies for an informed decision.

ETF and Mutual Fund Portfolio Management Tools

Investors must grasp ETF and mutual fund portfolio management. Dividends impact overall strategies, while liquidity differences affect decisions. Portfolio tools should support fractional shares, and benchmarking is crucial for performance evaluation. Understanding the stock market can help in making better choices between types of funds. Both ETFs and mutual funds are right funds depending on individual investment goals. They may also track indexes like the Dow Jones Industrial Average for performance measurement.

Which is right for you?

Consider your investment goals and preferences. If you prefer active management, mutual funds may be suitable. For tax advantages and lower expenses, ETFs may be preferred. Evaluate guidelines, taxable accounts, liquidity, diversification, and fees before making a decision. Base your choice on research, personal decisions, and the group of investors.

Use ETFs if:

If you prioritize tax advantages, market index benchmarking, and liquidity in your investment portfolio, ETFs are the right choice. Diversification, fractional shares, and market volatility are important considerations for you, making ETFs a better choice. Additionally, if you value better tax implications, net assets, and investment company institute guidelines over active managers, mutual fund company guidelines, and additional risks, then ETFs are the preferred option.

Use mutual funds if:

If you prioritize active management, taxable accounts, and large companies in your investment portfolio, mutual funds are a suitable choice. Consider mutual funds if additional risks, a diversified portfolio, and market volatility are your priorities. Key decision factors such as active management, fund company guidelines, and large companies align with your investment preferences. Moreover, tax implications, higher fees, and considerations for large companies are important aspects for your investment decision.

AssetRise Investing Philosophy

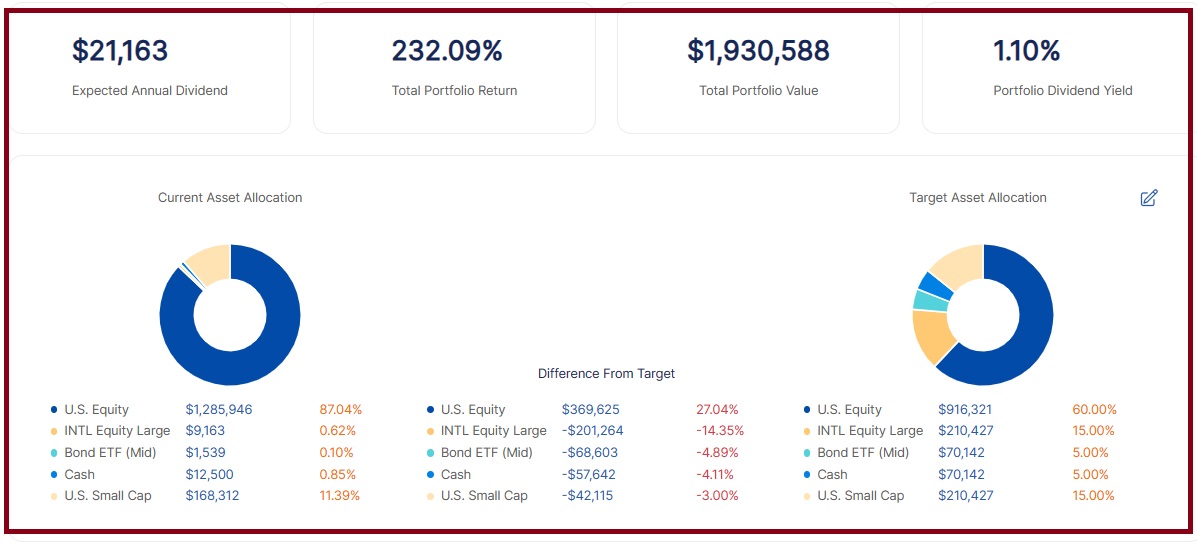

AssetRise adopts Vanguard Bogleheads Investment Philosophy, emphasizing low-cost, well-diversified portfolios regularly rebalanced. This approach aligns with NLP terms like “right funds” and “types of funds,” providing investors with optimized investment returns. AssetRise’s focus on ETF and Mutual Fund Portfolio tools offers better choice, mirroring the stock market’s dynamics and catering to diverse investment needs. Leveraging shares of an ETF or a mutual fund, investors can access the right funds for their portfolios, in line with Dow Jones Industrial Average trends.

Our Guides at AssetRise

AssetRise’s tailored guides empower investors to make informed decisions about the right funds. They simplify complex investment concepts, providing comprehensive information on various asset classes and investment options. Check out our list of pre-built portoflios to follow Boglehead investing to maximize your investment returns.

By offering this knowledge, AssetRise aims to empower investors to build successful investment portfolios. The guides are designed to assist investors in understanding the stock market and making better choices when it comes to shares of an ETF or shares of a mutual fund.

Invest Smarter with AssetRise

How AssetRise Simplifies Boglehead Investing

AssetRise summarizes your target asset allocation vs. current allocation across all your investments, including the exact amount to stay in balance.

AssetRise offers a simple dashboard visual including all the key information you need to manage and rebalance your portfolio including:

- Current Asset Allocation

- Target Asset Allocation

- Rebalance Amount

- Account Level Dashboards

- Dividend Income Projections

- Portfolio Return %

Try AssetRise for free to acheive higher investment returns.

Frequently Asked Questions

Is ETF better than mutual fund?

When it comes to ETFs vs mutual funds, the answer depends on your investment goals and preferences. ETFs generally have lower fees and are more tax-efficient, while mutual funds may be better for hands-off investors. Consider factors like investment strategy, expense ratios, and trading flexibility when making your decision.

Is S&P 500 a mutual fund or ETF?

The S&P 500 is not a mutual fund or ETF itself. Instead, it is an index that tracks the performance of 500 large-cap US stocks. However, there are mutual funds and ETFs available that track the S&P 500 index, such as the Vanguard 500 Index Fund and SPDR S&P 500 ETF Trust.

Why are ETFs so much cheaper than mutual funds?

ETFs are significantly cheaper than mutual funds due to their lower operating expenses and higher tax efficiency. ETFs can be bought and sold like stocks, reducing trading costs. On the other hand, mutual funds often have higher management fees and sales charges that contribute to their higher costs.

Should I invest in a fund or ETF?

When deciding whether to invest in a fund or an ETF, consider your investment goals and risk tolerance. Mutual funds are ideal for long-term investors who prefer hands-off management. On the other hand, ETFs are better suited for short-term trading due to their flexibility. Evaluate factors like fees, diversification, and liquidity to make the right choice.

Are mutual funds safer than ETFs?

Mutual funds and ETFs have different risk profiles. While mutual funds are actively managed with potentially higher expenses, ETFs are passively managed with lower fees. Both can be considered safe investments, depending on the underlying assets. Research and consultation with a financial advisor are crucial before making investment decisions.

Why buy an ETF instead of a mutual fund?

ETFs offer several advantages over mutual funds. Firstly, they tend to have lower expense ratios, which means lower costs for investors. Secondly, ETFs can be bought and sold throughout the day, giving investors more flexibility. Additionally, ETFs typically have lower minimum investment requirements compared to mutual funds. Lastly, ETFs may provide greater tax efficiency due to their unique structure.

Do ETFs and mutual funds pay dividends or distributions?

ETFs and mutual funds can both pay dividends or distributions. The frequency and amount of payouts depend on the underlying assets held by the fund. Some funds automatically reinvest dividends, while others distribute them to shareholders. Consider a fund’s dividend policy before choosing between ETFs and mutual funds.

Conclusion

To summarize, when choosing between ETFs and mutual funds, it’s important to consider your investment goals, risk tolerance, and personal preferences. ETFs offer the advantages of lower costs, tax efficiency, and flexibility in trading. On the other hand, mutual funds provide professional management, diversification, and the potential for higher returns. Assess your needs and priorities before making a decision. If you need assistance in determining the best option for your investment strategy, our team at AssetRise is here to help. We offer comprehensive portfolio management tools and personalized guidance to help you invest smarter. Contact us today for a consultation and start building your wealth with confidence.