As an investor you will need to track & report your asset allocation so you know when its time to rebalance. Portfolio rebalance is fundamental to Boglehead investing.

2 Steps to Rebalance Your Portfolio

In order to rebalance your portfolio you will need a rebalance portfolio calculator that provides the exact amount to rebalance. Here’s a link to a deeper blog post on portfolio rebalancing.

The challenge is many investors have multiple accounts, which introduces complexity.

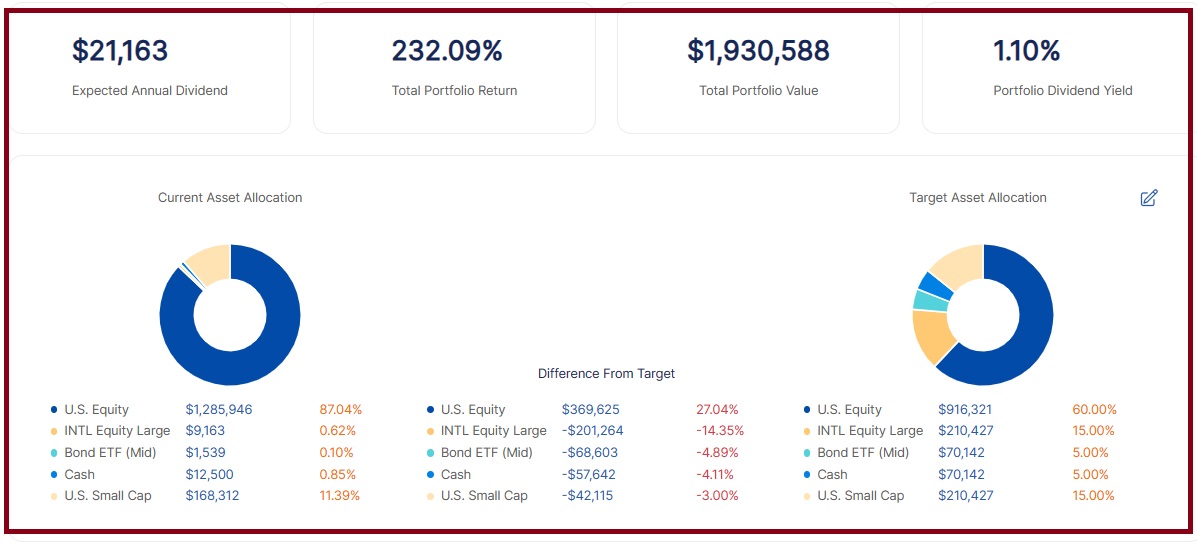

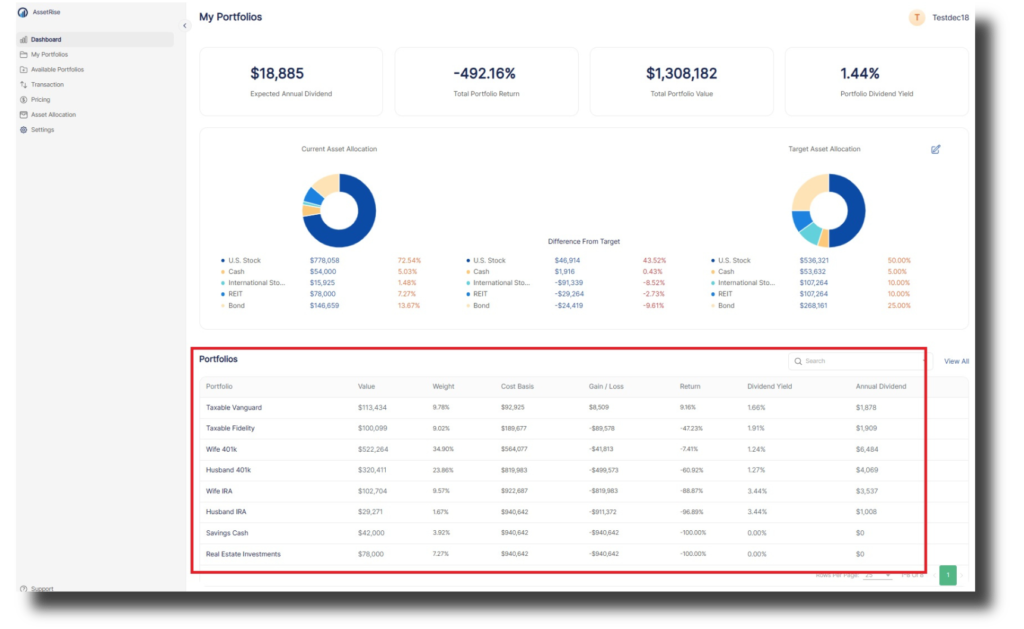

At Bogleblog we recommend AssetRise as its designed for Boglehead investors. AssetRise solves this problem by providing a rebalance portfolio calculator via a simple dashboard. AssetRise tracks your assets across accounts then aggregates to a current vs target allocation including the exact delta to keep your portfolio in balance.

As you can see below, AssetRise allows you to enter many portfolios then see a single asset allocation rebalance calculation by asset class.

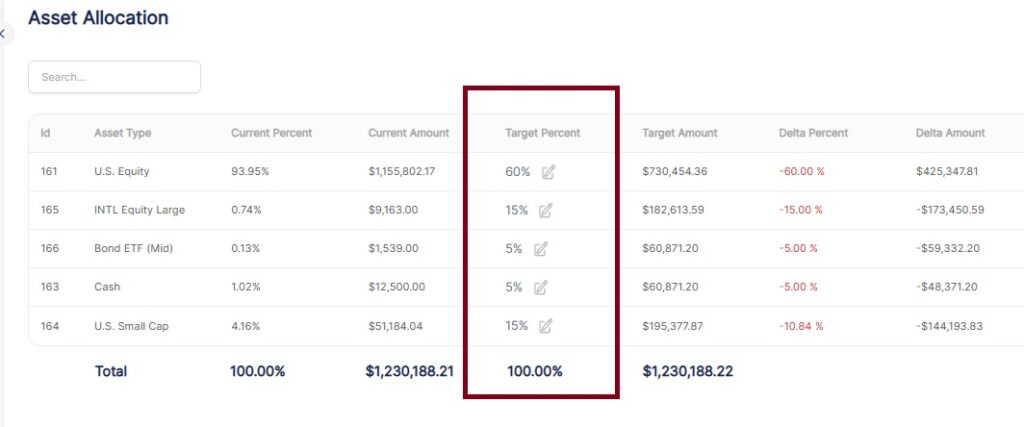

Step 1: Set Asset Allocation Target

AssetRise also allows investors to add an unlimited number of account portfolios while still providing a simple allocation.

Investors simply set their target allocation which will dynamically update your asset allocation. If an investor modifies assets, then AssetRise will dynamically update their asset allocation real time.

Here’s a YouTube video how to create a full rebalance portfolio calculation in under 5 minutes

Step 2: Manage and Rebalance

Now that we have covered your Asset Allocation and tool to manage your portfolio, you simply need to monitor and rebalance when needed.

I will point out that many investors rebalance not through buying and selling, but adding new money to their allocation.

So for example: if you at low in your Bond allocation, and are to invest a new lump sum of cash, then add the cash to your Bond allocation to reset to the desired allocation.

We cover rebalancing in detail in this blog post.

In Conclusion

Being a Boglehead investor is simple by design. You select a simple, 5 fund or less asset allocation, track & manage your assets, and rebalance as needed.

After you are setup as an investor, it will sometimes feel “boring” as there’s not much to do! This is a very good thing, as you are enjoying the returns of passive investing while you focus your time in life on higher priorities.

Reduce your stress level through simplicity not complexity.