Investing can be overwhelming. In my journey, I found these books to guide my Boglehead investing strategy.

This blog post is the top 10 Boglehead books I used to craft my investment strategy including my key takeaways from each book.

I hope this helps to shortcut your path to Vanguard Boglehead investing.

Bogleheads Guide to Investing is a foundational book to the Bogleheads community.

Key Takeways:

- I learned the Boglehead guiding principles covered in detail in this Blog

- The Boglehead 3 Fund Portfolio is the staple investment as it keeps investing simple, diversified, and low cost

- Jack Bogle founded Vanguard

- Bogleheads are a massive community including local community meetings

#2: Common Sense of Investing

Common Sense Investing is a foundational book to the Bogleheads community.

Key Takeways:

- I learned the Boglehead guiding principles covered in detail in this Blog

- The Boglehead 3 Fund Portfolio is the staple investment as it keeps investing simple, diversified, and low cost

- Jack Bogle founded Vanguard

- Bogleheads are a massive community including local community meetings

#3: The Intelligent Investor

Ben Graham was an early innovator of value investing, which included a great deal of research and data points on the stock market over time.

Key Takeways:

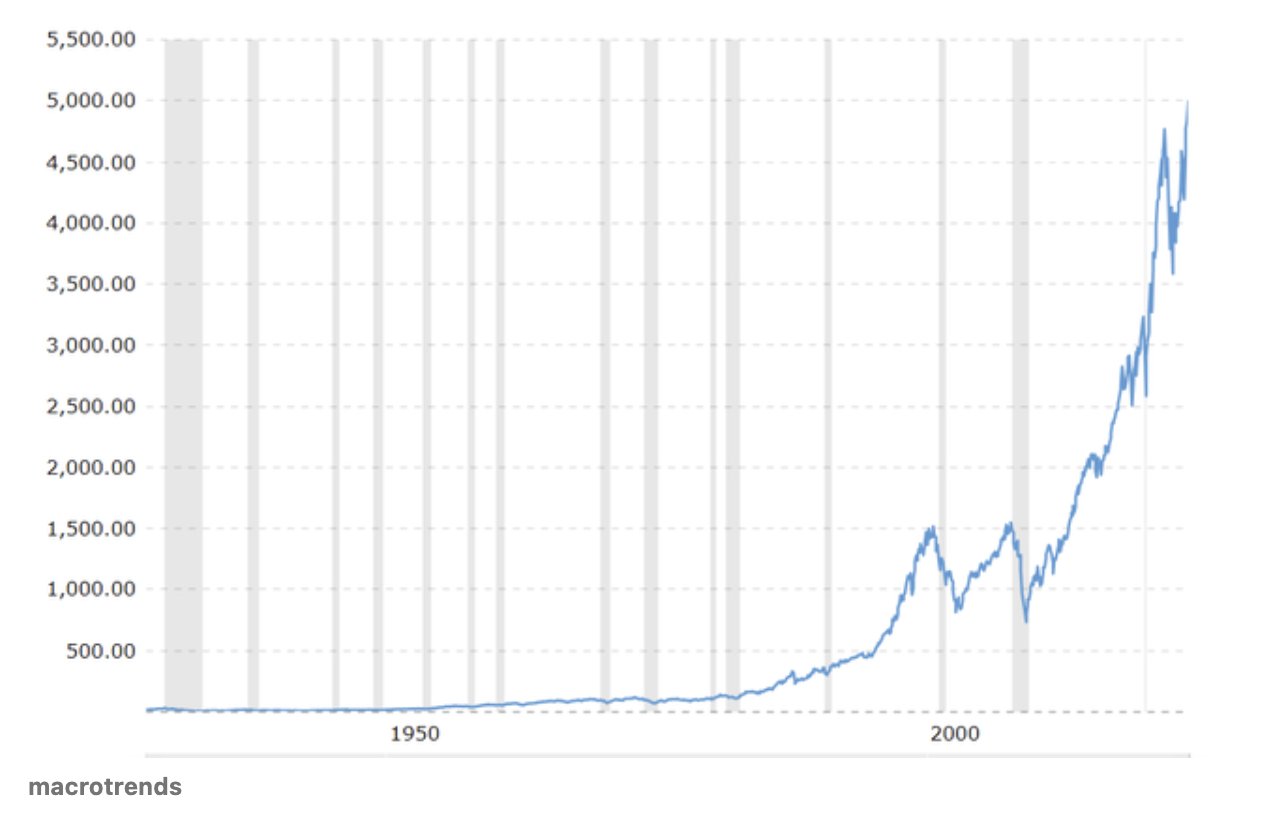

- The historical stock market increases over time

- Rebalancing portfolios is to reduce volatility

- Stocks will outperform bonds but be more volatile

#4: The Millionare Next Door

Millionare Next Door is an important foundational book for investors as it explains how to structure your finances from a young age.

Key Takeways:

- Structure your finances as a “pie chart” of savings, expenses, and disposable income

- Hit your savings targets, then expenses, then disposable income

- Spend your disposable income freely, but only after you hit your savings targets