This blog weighs the benefits of dollar cost averaging vs. lump sum investing for a Boglehead investor.

What was my path to Bogleheads?

I found Bogleheads out of necesitty. After trying a few Advisors at Merril Lynch and UBS, I realized they did not have my best interests at heart. So I had no choice but to manage my finances myself until a better option presented itself.

I knew that stock picking was not the way. After much research I came across the Bogleheads.org forum online, and knew it fit my investment management needs.

After finding the Bogleheads Guide to Investing, that became my investment blueprint for my lifetime.

So after 15 years of Boglehead Investing, why did I pick Boglehead Investing and what have I learned?

What were my requirements for an investment strategy?

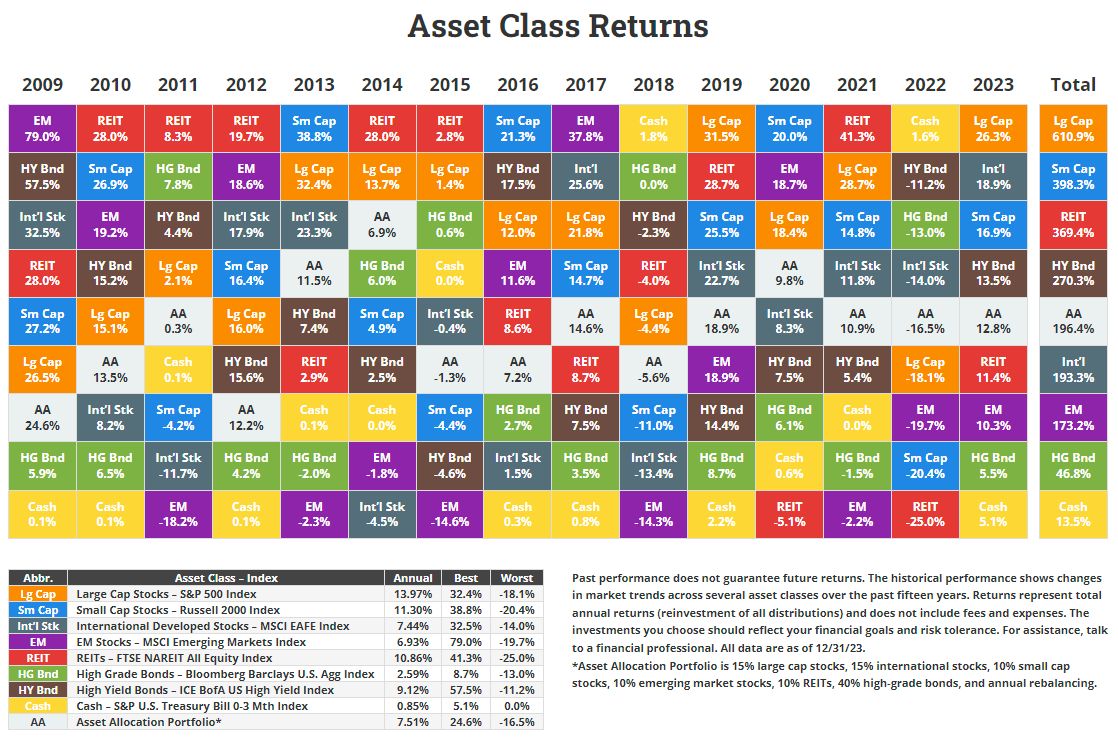

First I needed a strategy for when the market was performing well, going down, and even sideways. Second I could not spend too much time researching investments as I have a full time job and family. Last, it needed to be simple and proven over a long period of time.

What other options did I try?

- Financial Advisors at UBS and Morgan Stanley

- Jim Cramer stock picking on CNBC

- Zacks Stock Picking

- The Motley Fool Stock Picking

- Buying high risk penny stocks hoping to hit it big

So let me tell you what I learned, compare and contrast vs. Boglehead Investing.

Financial Advisors

Are all financial advisors bad? Heck no. There are many great advisors out there, especially for wealthy clients who need advice on tax benefits or need a wholistic plan of their estate. However for the rest of us, advisors will follow a company template blindly without actually understanding financial planning themselves. Also, their interests are misalinged to their clients as the advisor makes money off your portfolio no matter the return on investment. Where you are stuck with a poor investment return.

Jim Cramer and CNBC

Jim is very entertaining. If you are looking for a hedge fund manager then maybe he’s the guy for you. CNBC makes money when there is panic, so they need to create a sense of urgency to spoke ratings. Also, their guests talk about the buying in and out of the market, which is a form of Market Timing which Bogleheads to do not.

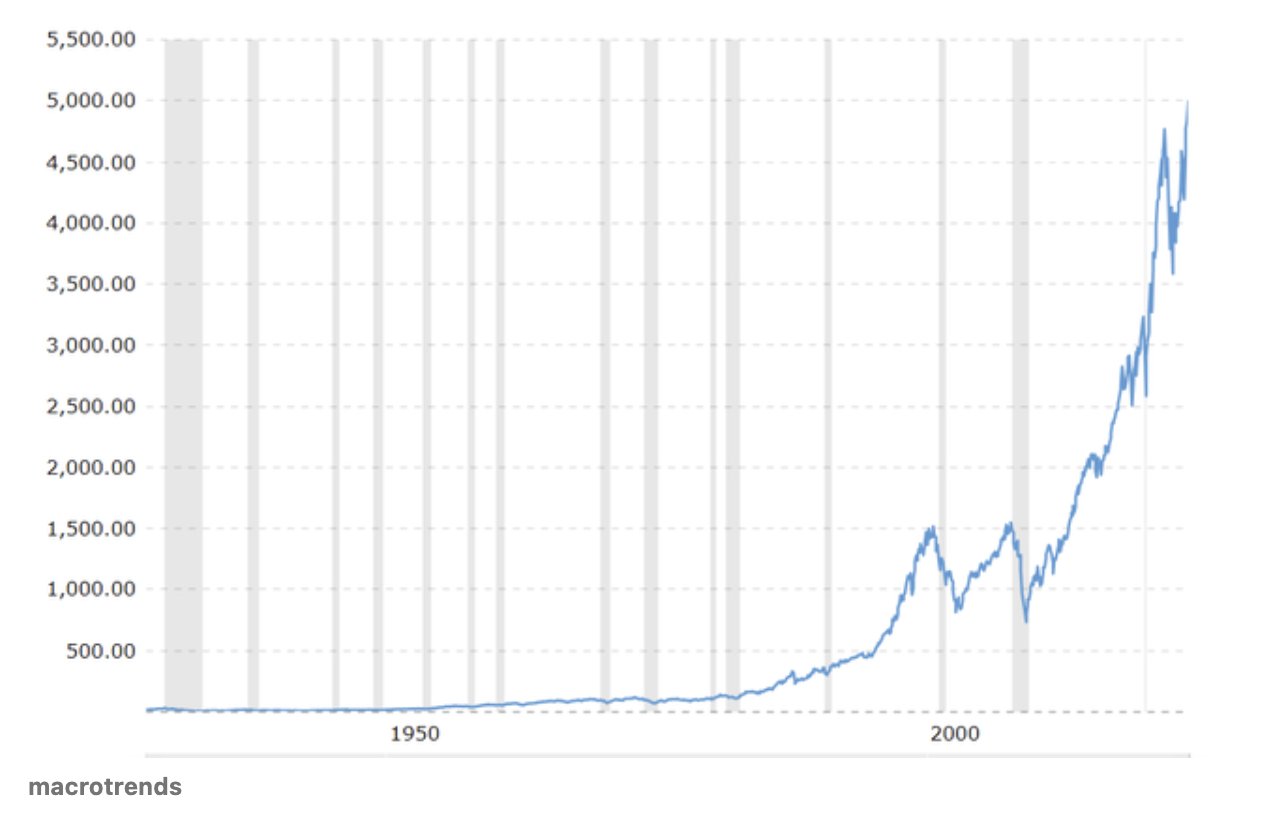

As an individual investor you need a portfolio plan not just picking stocks. Also, do you really have hours a day to research stocks? How about market timing? Do you really believe you can beat a simple stock index when Active Mutual Fund managers cannot beat the S&P 500? Here’s the Bogleheads view on Market Timing and a blog on our site breaking down ETF’s vs. Mutual Funds including Active Management vs. Passive Management.

The Motley Fool and Zacks, Penny Stocks

I could have lumped these into the Jim Cramer category as stock picking. Each of these services recommend a stock to buy every few weeks. When the markets are strong, such as a tech stock bubble they may hit on a few (Tesla, Amazon) but will miss on most. Also, how do you know when to get into a stock and when to sell?

Similar to “penny stocks”, nothing wrong with setting aside a few bucks to maybe hit on a few. But is that really a long term wealth building strategy?

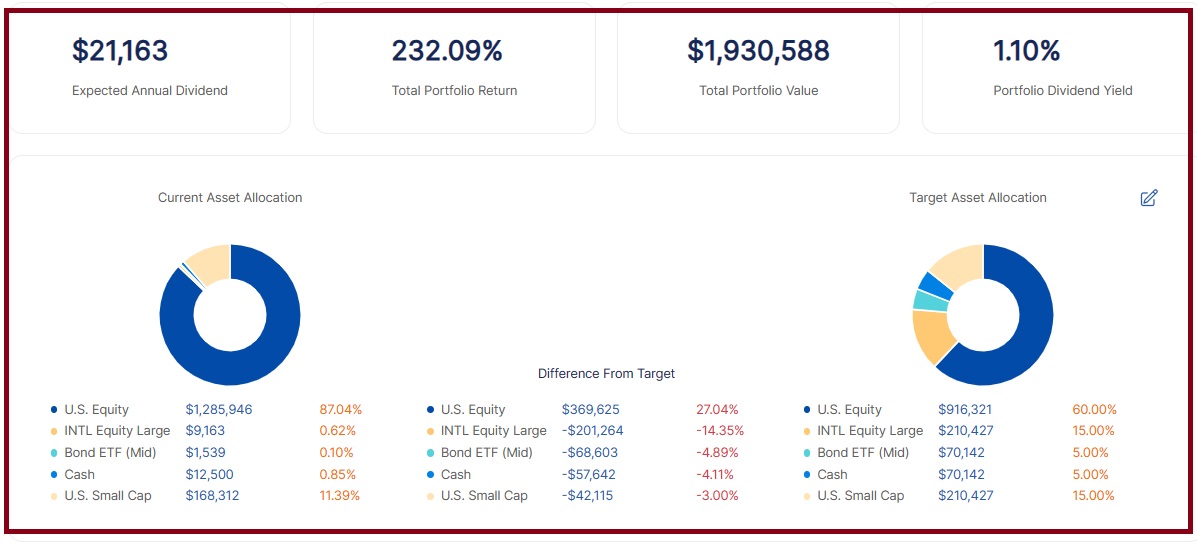

What I’ve seen many investors do is set aside a small amount of their portfolio into stock picking (betting) but keep the majority in a Boglehead “Lazy Portfolio” including index funds managed with a tool like AssetRise for rebalancing.

Bogleheads.org to the Rescue

After researching investing into life insurance policies, I came across posts on the bogleheads.org forums of why that was a bad idea. And they were right. The policy paid the insurance company’s pockets but not mine!

So I dove into every book and post I could find to learn the Boglehead way of investing.

The strange thing is it was very simple! I was used to my financial manager constantly buying and selling stocks and alternative investments. The concept of only buying 5 index funds was a big relief.

In Conclusion

15 years later I’m even more sold on the Vanguard Bogleheads investment. It has helped me to generate 10%+ compounding return to acheive my financial goals.

I wish you the best on your investing journey.